[Hot Focus]: Tracking the upstream and downstream situation of natural rubber as the Spring Festival holiday approaches

1. Upstream output

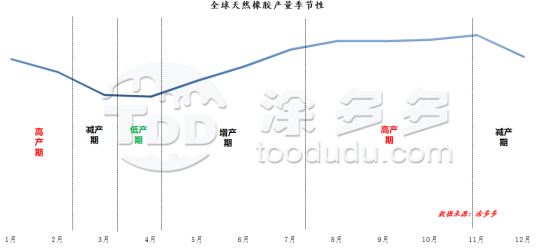

It can be seen from the seasonal trend chart of global natural rubber output that global natural rubber output has also entered a period of production reduction near the Spring Festival prices. Next, until April, global natural rubber output remains in a low-yield period. In terms of cost, upstream support is still in a relatively favorable state. They are divided into different regions.

In Thailand's producing areas, northeastern Thailand has successively entered the season of cutting and production reduction. The output in the southern part of Thailand, which is the main supply, also fell short of expectations. Powdery mildew and fallen leaves disturbed the output, and the falling leaves have arrived earlier. As the booming production in the south is coming to an end, it is expected that Thailand as a whole The cutting stop period during the year was about 1-2 weeks earlier than in previous years. Factories and secondary suppliers actively hoded raw materials for inventory, which in turn drove Thailand's raw material prices to remain firm at a high level.

Rubber leaves in Vietnam's production areas have turned yellow and fallen leaves, and large areas of rubber-producing areas have entered a state of suspension of cutting. So far, the inventory pressure of finished products in rubber processing plants has eased compared with previous years, and there is low willingness to ship at low prices. It is expected that processing plants will stop around the Chinese Spring Festival. Purchase raw materials and carry out finishing work, and the cutting suspension period will follow.

China's Hainan and Yunnan production areas have entered a cutting suspension period, among which private dry rubber factories in Yunnan production areas have also been suspended one after another; Hainan production areas have also officially entered a cutting suspension period in mid-to-late January, and the concentrated milk production line of private processing plants is in a state of suspension. As far as China's processing plants are concerned, the inventory of finished products in the factory is relatively low compared with previous years. In addition, most downstream processing plants have holidays in advance before the Spring Festival holiday, and actual procurement is weak. Processing plants have more willingness to ship before the Spring Festival, and most of them are used for sale at a quoted price during the downstream resumption of work.

2、下游开工

Before the Spring Festival holiday in 2024, the production scheduling and holidays of downstream processing plants are also significantly different from previous years. Among them, driven by the active export of semi-steel tires, the finished product inventories of many companies remain low, and the enthusiasm of companies to schedule production remains high. After the holiday, various companies may actively resume work and production to meet order demand. However, exports of all-steel tires have weakened, and the domestic market has fallen to a "freezing point" earlier than in previous years. Channel and terminal stores are not optimistic about post-holiday demand, and only maintain the strategy of just replenishing and digesting inventory before the holiday.

Semi-steel tire companies: During the Spring Festival of 2024, the number of holiday days in most processing factories has decreased to varying degrees compared with the same period last year. From February 1 to 3, nearly 30% of processing factories began to arrange holidays. Starting from February 4, nearly 60% of enterprises began to suspend work and have holidays. Only a few enterprises arranged normal production schedules during the Spring Festival.

Semi-steel tire enterprises: During the Spring Festival in 2024, the number of holiday days for semi-steel tire enterprises will basically remain at around 10 days, which is similar to the relative situation in the same period last year, with fewer changes. From January 31 to around February 2, nearly 60% of enterprises began to have holidays one after another. Starting from February 3, nearly 40% of enterprises began to arrange work stoppages and holidays one after another.