78,849

February 29, 2024, 10:19 AM

Analysis of natural rubber market price on February 28

index

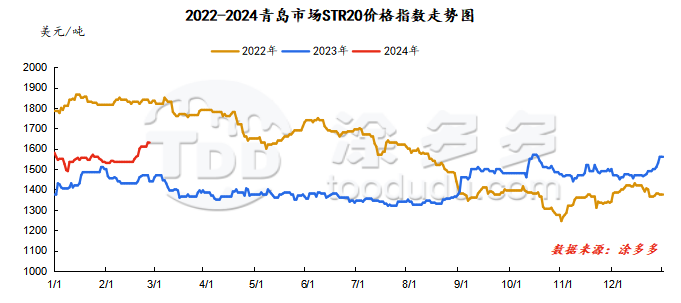

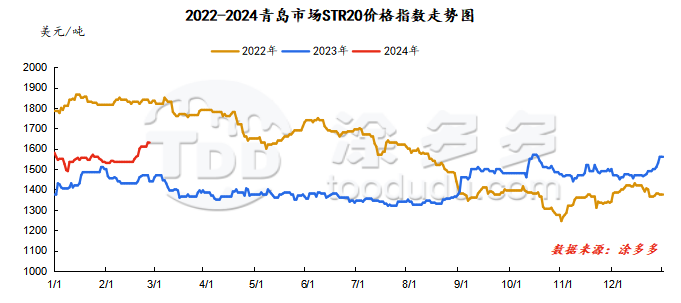

On February 28, the STR20 price index of natural rubber in the Qingdao market was US$1630/ton, which was unchanged from yesterday.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

28 February

|

13950

|

13900

|

14030

|

13950

|

15115

|

13950

|

14105

|

|

on February 27

|

13770

|

13765

|

14015

|

13965

|

15140

|

13965

|

14115

|

|

rise and fall

|

180

|

135

|

15

|

-15

|

-25

|

-15

|

-10

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

28 February

|

11880

|

11930

|

11930

|

11900

|

|

on February 27

|

11925

|

11950

|

11965

|

11970

|

|

rise and fall

|

-45

|

-20

|

-35

|

-70

|

spot market

Supply:

Foreign: Thailand's raw material market is in short supply, prices have increased slightly, and cost support is still acceptable.

China: China's production areas have entered a cut-off period, and raw material prices are not available.

|

price type

|

on February 27

|

28 February

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

68.75

|

69.25

|

0.5

|

baht/kg

|

|

cup glue

|

53.65

|

53.7

|

0.05

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

rubber block

|

|

|

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

|

|

|

Yuan/ton

|

On the demand side: There is currently a shortage of some models in the semi-steel tire market; the peak of full-steel tire shipments after the holiday has been delayed compared with previous years. In terms of the market, the overall operating load of the downstream tire industry is relatively stable. Some companies have raised their price policies, and others have the willingness to follow up. However, the overall performance of terminal demand is weak, and more companies have stable price policies.

Futures spot price list

|

price type

|

on February 27

|

28 February

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13233

|

13233

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1630

|

1630

|

0

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

13050

|

13050

|

0

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

11600

|

11450

|

-150

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

12700

|

12800

|

100

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

915

|

900

|

-15

|

Yuan/ton

|

|

Main force-China All Latex

|

732

|

717

|

-15

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2146

|

7.2156

|

0.001

|

Yuan

|

|

Thai Baht to RMB

|

0.2048

|

0.2049

|

0.0001

|

Yuan

|

market outlook

The supply of raw materials in the overseas rubber market is relatively tight, and the price policy in the Thai market is not yet in place; the overall inventory of the natural rubber market remains high. Although downstream companies have resumed work and production, the inventory of finished products on the site has accumulated serious, and the demand for raw materials is mostly just demand. It is expected that the short-term natural rubber market prices are stable.