Analysis of natural rubber market price on March 5

index

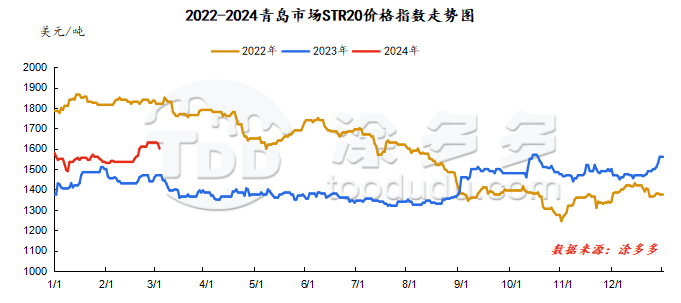

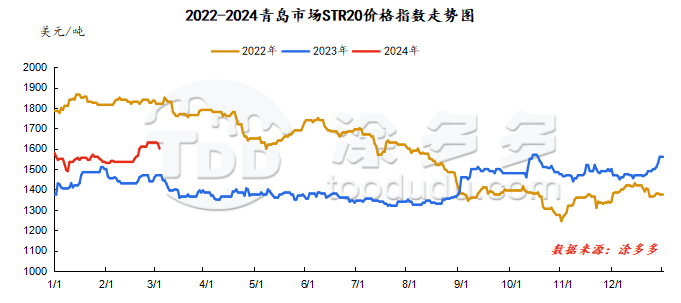

On March 5, the STR20 price index of natural rubber in the Qingdao market was US$1600/ton, down 25 or 1.5% from the previous working day.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

March 5

|

13850

|

13700

|

13880

|

13780

|

14965

|

13780

|

13910

|

|

March 4

|

13950

|

13755

|

13955

|

13850

|

15020

|

13850

|

13975

|

|

rise and fall

|

-100

|

-55

|

-75

|

-70

|

-55

|

-70

|

-65

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

March 5

|

11645

|

11905

|

11645

|

11710

|

|

March 4

|

11710

|

11910

|

11710

|

11780

|

|

rise and fall

|

-65

|

-5

|

-65

|

-70

|

spot market

Supply:

Foreign: Thailand's raw material market is improving, glue prices continue to increase, and glue cup prices are stable today.

China: China's production areas have entered a cut-off period, and raw material prices are not available.

|

price type

|

March 4

|

March 5

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

71.8

|

72.3

|

0.5

|

baht/kg

|

|

cup glue

|

53.85

|

53.85

|

0

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

rubber block

|

|

|

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

|

|

|

Yuan/ton

|

On the demand side: Semi-steel tire companies 'shipments have returned to pre-year levels, foreign trade orders are sufficient, domestic sales are out of stock, and on-site inventories remain low; shipments in the all-steel tire market have dropped from last week, and the company's output has increased rapidly after the year., on-site inventory digestion is slow, and company sales pressure increases. In terms of the market, most tire companies have stable price policies, and some provide certain promotional policies to merchants.

Futures spot price list

|

price type

|

March 4

|

March 5

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13133

|

13033

|

-100

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1625

|

1600

|

-25

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

12930

|

12880

|

-50

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

11450

|

11450

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

12700

|

12700

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

920

|

900

|

-20

|

Yuan/ton

|

|

Main force-China All Latex

|

717

|

747

|

30

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2146

|

7.2141

|

-0.0005

|

Yuan

|

|

Thai Baht to RMB

|

0.205

|

0.2053

|

0.0003

|

Yuan

|

market outlook

China's raw material production areas have been suspended, there is no supply of goods in Southeast Asia and Vietnam, Thailand's output has been significantly reduced, factory costs have risen, raw material procurement has remained in a tight demand, and market supply has been tight; the capacity utilization rate of the downstream tire industry continues to rise, but market inventory digestion is slow, and terminal performance fell short of expectations, and natural rubber market prices are expected to remain stable in the short term.