Analysis of natural rubber market price on March 6

index

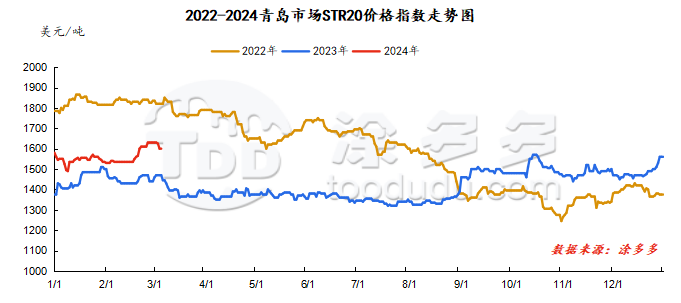

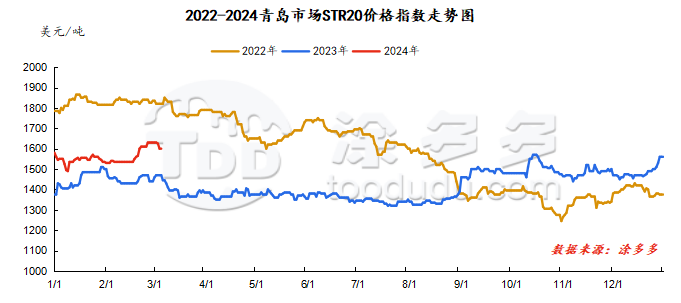

On March 6, the STR20 price index of natural rubber in the Qingdao market was US$1600/ton, which was unchanged from yesterday.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

March 6

|

13780

|

13675

|

13830

|

13805

|

15000

|

13850

|

13940

|

|

March 5

|

13850

|

13700

|

13880

|

13780

|

14965

|

13780

|

13910

|

|

rise and fall

|

-70

|

-25

|

-50

|

25

|

35

|

70

|

30

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

March 6

|

11650

|

11905

|

11650

|

11750

|

|

March 5

|

11645

|

11905

|

11645

|

11710

|

|

rise and fall

|

5

|

0

|

5

|

40

|

spot market

Supply:

Foreign: The output of raw materials in the Thai market continues to decline, and the prices of glue and rubber cups continue to increase.

China: China's production areas have entered a cut-off period, and raw material prices are not available.

|

price type

|

March 5

|

March 6

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

72.3

|

72.8

|

0.5

|

baht/kg

|

|

cup glue

|

53.85

|

54.3

|

0.45

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

rubber block

|

|

|

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

|

|

|

Yuan/ton

|

On the demand side: Semi-steel tire companies 'shipments have returned to pre-year levels, foreign trade orders are sufficient, domestic sales are out of stock, and on-site inventories remain low; shipments in the all-steel tire market have dropped from last week, and the company's output has increased rapidly after the year., on-site inventory digestion is slow, and company sales pressure increases. In terms of the market, the weather has gradually warmed up and logistics transportation has gradually increased. However, there are more vehicles and less work, and terminal demand has not performed as expected.

Futures spot price list

|

price type

|

March 5

|

March 6

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13033

|

13033

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1600

|

1600

|

0

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

12880

|

12850

|

-30

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

11450

|

11450

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

12700

|

12550

|

-150

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

900

|

930

|

30

|

Yuan/ton

|

|

Main force-China All Latex

|

747

|

747

|

0

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2141

|

7.2152

|

0.0011

|

Yuan

|

|

Thai Baht to RMB

|

0.2053

|

0.205

|

-0.0003

|

Yuan

|

market outlook

China's raw material production areas have stopped cutting in all its industries, Southeast Asia and Vietnam have no supply of goods, Thailand's output has been significantly reduced, factory costs have risen, raw material procurement has remained in a tight demand, and market supply has been relatively tight; most downstream tire companies have started and operated smoothly, and the overall shipment performance has been lukewarm. Inventory consumption in the field is slow, and natural rubber market prices are expected to remain stable in the short term.