Analysis of natural rubber market price on March 8

index

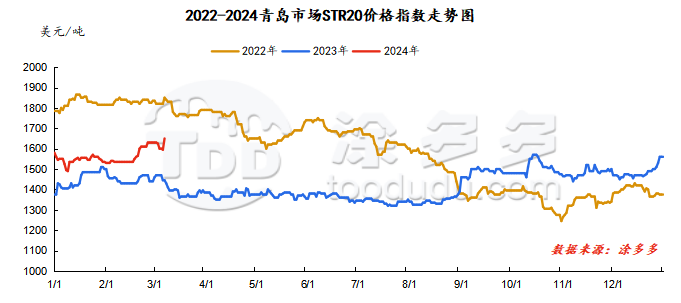

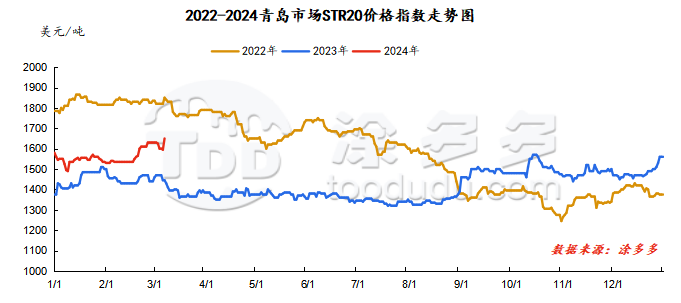

On March 8, the STR20 price index of natural rubber in the Qingdao market was US$1650/ton, up 55 from yesterday, or 3.45%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

March 8

|

13750

|

13720

|

14295

|

14250

|

15385

|

14250

|

14370

|

|

March 7

|

13835

|

13675

|

13880

|

13725

|

14940

|

13725

|

13885

|

|

rise and fall

|

-85

|

45

|

415

|

525

|

445

|

525

|

485

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

March 8

|

11935

|

11995

|

11935

|

12020

|

|

March 7

|

11570

|

11905

|

11570

|

11695

|

|

rise and fall

|

365

|

90

|

365

|

325

|

spot market

Supply:

Foreign countries: Thailand's raw material market supply is low, glue prices are rising again, and rubber cup prices are stable.

China: China's rubber trees are rising well and are expected to cut normally.

|

price type

|

March 7

|

March 8

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

73.2

|

73.5

|

0.3

|

baht/kg

|

|

cup glue

|

54.35

|

54.35

|

0

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

rubber block

|

0

|

0

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

0

|

0

|

0

|

Yuan/ton

|

On the demand side: The semi-steel tire industry has resumed its regular shipping model, market supply remains low, and the shortage of supplies for some models continues; the price policy of the all-steel tire market is stable, merchants are not enthusiastic about purchasing, on-site inventory is slowly digested, and insufficient market demand is replaced. In terms of the market, supply and demand in the semi-steel tire and all-steel tire markets are mixed. Companies flexibly adjust price policies for shipment, and tire market prices fluctuate.

Futures spot price list

|

price type

|

March 7

|

March 8

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13133

|

13100

|

-33

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1595

|

1650

|

55

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

12810

|

13180

|

370

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

11450

|

11450

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

12550

|

12650

|

100

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

915

|

1070

|

155

|

Yuan/ton

|

|

Main force-China All Latex

|

592

|

1150

|

558

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2161

|

7.2129

|

-0.0032

|

Yuan

|

|

Thai Baht to RMB

|

0.2062

|

0.2065

|

0.0003

|

Yuan

|

market outlook

China's rubber trees are rising well and are expected to be cut normally. There is no supply of goods abroad in Southeast Asia and Vietnam. The supply of raw materials in Thailand is low. Market prices continue to rise, and cost support is strong. China's natural rubber is slowly removed from the warehouse, and dark colors perform better than light colors. Qingdao is more obvious. The capacity utilization rate of the downstream tire and rubber products industry has gradually recovered. Some companies maintain high start-ups and high loads, and there is certain support on the demand side. It is expected that the natural rubber market will operate strongly in the short term.