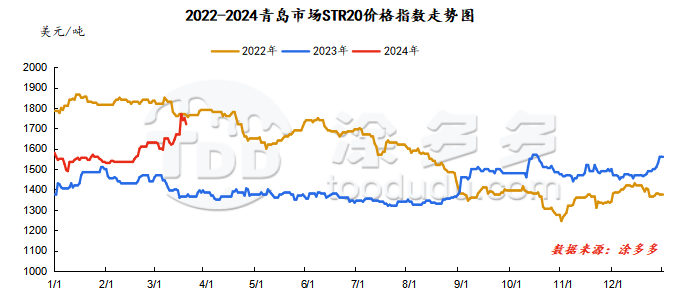

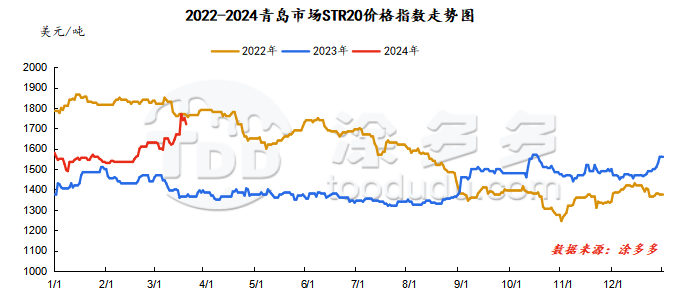

Analysis of natural rubber market price on March 21

index

On March 21, the STR20 price index of natural rubber in the Qingdao market was US$1720/ton, down 30 or 1.7% from yesterday.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

March 21

|

15305

|

14920

|

15405

|

14940

|

16130

|

14940

|

15055

|

|

March 20

|

15315

|

15235

|

15575

|

15390

|

16535

|

15390

|

15485

|

|

rise and fall

|

-10

|

-315

|

-170

|

-450

|

-405

|

-450

|

-430

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

March 21

|

12350

|

12740

|

12350

|

12650

|

|

March 20

|

12705

|

13020

|

12705

|

12950

|

|

rise and fall

|

-355

|

-280

|

-355

|

-300

|

spot market

Supply:

Foreign countries: Cutting has been suspended in many rubber raw material producing areas around the world, and Thailand's raw material prices have fluctuated at high levels.

China: Although China is affected by dry weather, raw materials in Yunnan and Hainan production areas are growing well and are expected to be successfully harvested.

|

price type

|

March 20

|

March 21

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

81

|

81.2

|

0.2

|

baht/kg

|

|

cup glue

|

57.65

|

57.55

|

-0.1

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

rubber block

|

0

|

0

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

0

|

0

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

0

|

0

|

0

|

Yuan/ton

|

On the demand side: Most semi-steel tire companies have raised their price policies by about 3%, and some companies have already implemented new prices and implemented them at the end of February; most all-steel tire companies have raised their price policies by about 3%, and some companies have increased their prices by 8%. Most new prices will be implemented in April, and it will take some time for the actual price to be implemented. In terms of the market, the final market performance was weak, and the negative atmosphere in the tire market quietly spread.

Futures spot price list

|

price type

|

March 20

|

March 21

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

14683

|

14483

|

-200

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1750

|

1720

|

-30

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

14040

|

13750

|

-290

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

12100

|

12000

|

-100

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

13300

|

13300

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1350

|

1190

|

-160

|

Yuan/ton

|

|

Main force-China All Latex

|

707

|

457

|

-250

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2162

|

7.2153

|

-0.0009

|

Yuan

|

|

Thai Baht to RMB

|

0.2037

|

0.2043

|

0.0006

|

Yuan

|

market outlook

Recently, affected by drought and severe weather, many rubber raw material producing areas around the world have stopped cutting. The scarcity of output has led to continued high prices, which has strong support for rubber costs. During the period of suspension of Chinese raw materials, there is no supply in the market; today, China's natural rubber market prices have fallen, and on-site trading performance has been lukewarm; the downstream tire industry has a certain resistance to high-priced rubber, and the company's early inventory has not yet been fully digested. Most of the actual purchases are based on just needs. It is expected that the natural rubber market will consolidate in the short term.