Analysis of natural rubber market price on April 22

index

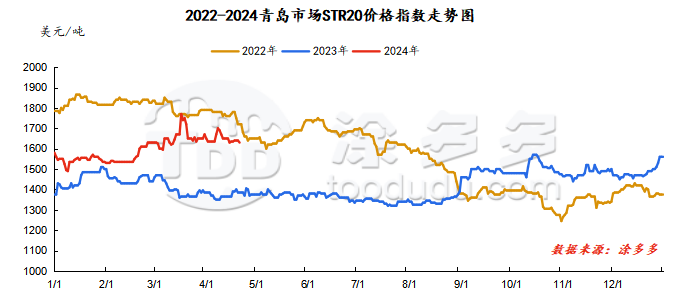

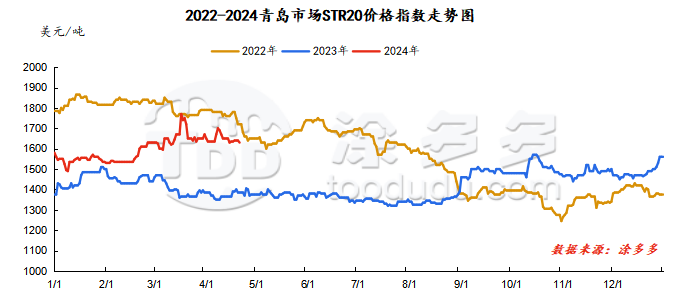

On April 22, the STR20 price index of natural rubber in the Qingdao market was US$1630/ton, down 10 or 0.6% from the previous working day.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

April 22

|

14550

|

14400

|

14700

|

14415

|

15515

|

14185

|

14415

|

|

April 19

|

14595

|

14450

|

14720

|

14565

|

15695

|

14335

|

14565

|

|

rise and fall

|

-45

|

-50

|

-20

|

-150

|

-180

|

-150

|

-150

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

April 22

|

11765

|

12470

|

11580

|

12040

|

|

April 19

|

11830

|

12420

|

11655

|

12065

|

|

rise and fall

|

-65

|

50

|

-75

|

-25

|

spot market

Supply:

Foreign: Thailand's raw material prices fluctuated downward. Today, glue was raised and rubber cups were lowered.

China: China's raw material output is low, while Yunnan and Hainan are tight and prices are rising.

|

price type

|

April 19

|

April 22

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

70

|

70.5

|

0.5

|

baht/kg

|

|

cup glue

|

54.5

|

54.35

|

-0.15

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

12900

|

13100

|

200

|

Yuan/ton

|

|

rubber block

|

11600

|

11700

|

100

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

14000

|

14000

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

15700

|

15800

|

100

|

Yuan/ton

|

On the demand side: Semi-steel tire enterprises started operating more than 80%, a slight increase from the previous month and an increase of 2 percentage points compared with the same period last year; the operating rate of the all-steel tire market exceeded 70%, a slight decrease from the previous month and a decrease of 1 percentage point compared with the same period last year. In terms of the market, the capacity utilization rate of the tire industry is mixed, corporate loads remain high, and finished product inventories show an upward trend.

Futures spot price list

|

price type

|

April 19

|

April 22

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13833

|

13733

|

-100

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1640

|

1630

|

-10

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

13360

|

13280

|

-80

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

11400

|

11300

|

-100

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

12200

|

12100

|

-100

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1205

|

1135

|

-70

|

Yuan/ton

|

|

Main force-China All Latex

|

732

|

682

|

-50

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2602

|

7.2592

|

-0.001

|

Yuan

|

|

Thai Baht to RMB

|

0.2004

|

0.1999

|

-0.0005

|

Yuan

|

market outlook

The downward adjustment in overseas raw material prices has weak support for rubber costs; China's Yunnan and Hainan production areas are in progress, the market supply is low, and raw material prices are tight; today, China's natural rubber market prices have fallen within a narrow range, and port inventories have maintained a downward trend; Domestic and external sales and shipments of the downstream tire industry are less than last month. Tire companies are making up for stocks at bargain hunting, and terminals are just in need of support. It is expected that the natural rubber market will operate weakly in the short term.