Analysis of natural rubber market price on May 15

index

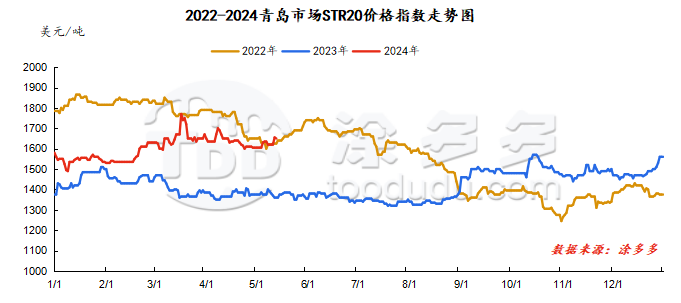

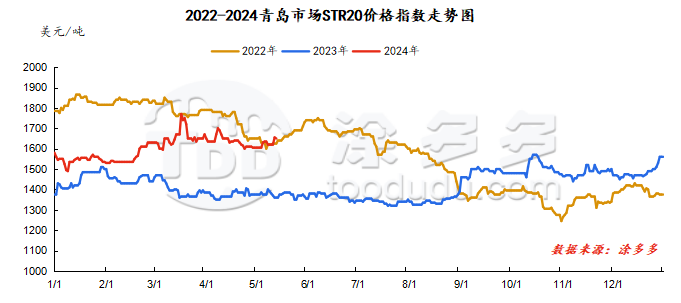

On May 15, the STR20 price index of natural rubber in the Qingdao market was US$1650/ton, which was the same as yesterday.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

on May 15

|

14310

|

14295

|

14455

|

14430

|

15475

|

14075

|

14380

|

|

May 14

|

14480

|

14295

|

14585

|

14310

|

15565

|

14090

|

14465

|

|

rise and fall

|

-170

|

0

|

-130

|

120

|

-90

|

-15

|

-85

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

on May 15

|

12020

|

12440

|

11715

|

12160

|

|

May 14

|

12050

|

12530

|

11715

|

12180

|

|

rise and fall

|

-30

|

-90

|

0

|

-20

|

spot market

Supply:

Foreign: Thailand's raw material prices continue to rise, while Malaysia's raw material prices are mixed.

China: Hainan's raw material prices have increased, while Yunnan's raw material prices have declined.

|

price type

|

May 14

|

on May 15

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

75.5

|

75.8

|

0.3

|

baht/kg

|

|

cup glue

|

55.7

|

56.35

|

0.65

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

13400

|

13300

|

-100

|

Yuan/ton

|

|

rubber block

|

11800

|

11800

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

13000

|

13000

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

14300

|

14500

|

200

|

Yuan/ton

|

On the demand side: Orders from semi-steel tire companies increased by 10% compared with the previous month, 60% remained flat, and 30% decreased. The number of orders from enterprises slowly declined; orders from all steel tire companies were 30% unchanged compared with the previous month, and 70% decreased. Overall shipments fell significantly. In terms of the market, demand for tire replacement at home and abroad is sluggish. Recently, some tire companies have carried out low-load production to reduce pressure.

Futures spot price list

|

price type

|

May 14

|

on May 15

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13683

|

13633

|

-50

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1650

|

1650

|

0

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

13365

|

13355

|

-10

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

11500

|

11550

|

50

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

12350

|

12350

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

945

|

1075

|

130

|

Yuan/ton

|

|

Main force-China All Latex

|

627

|

797

|

170

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2547

|

7.2507

|

-0.004

|

Yuan

|

|

Thai Baht to RMB

|

0.2037

|

0.2051

|

0.0014

|

Yuan

|

market outlook

Affected by cruel weather, the rubber tapping process in raw material production areas at home and abroad has been slow, and the market supply tension is difficult to alleviate. Market prices remain high, which provides reasonable support for rubber costs. Today, China's natural rubber market prices are high and volatile, and some ports are out of stock. The phenomenon is obvious, and most of them are mainly based on shipping and cargo quotations; downstream tire companies are not enthusiastic about starting replenishment and only maintain just demand for rubber raw materials. It is expected that the natural rubber market will operate steadily in the short term.