Exports of carbon black tires rose in the first quarter, and data in sub-sectors were gratifying

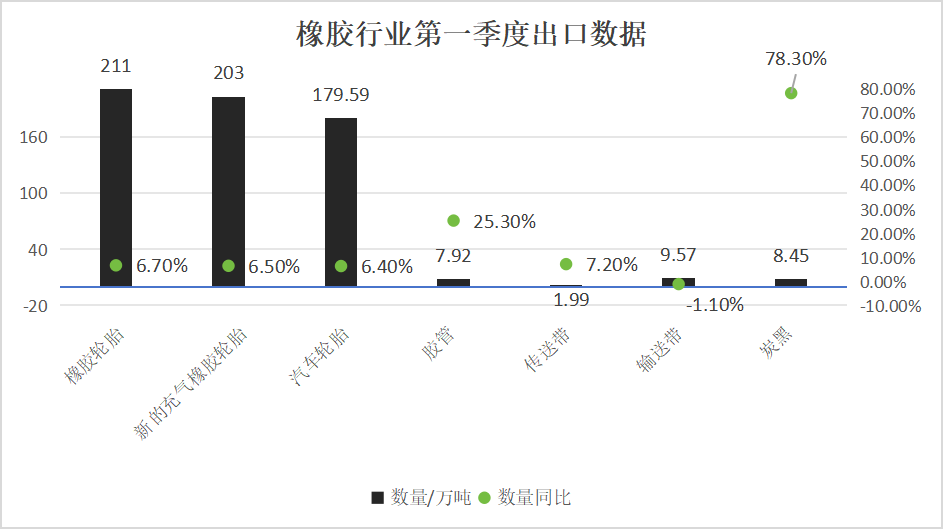

Export figures for the first quarter of the tire and rubber industry have been released.

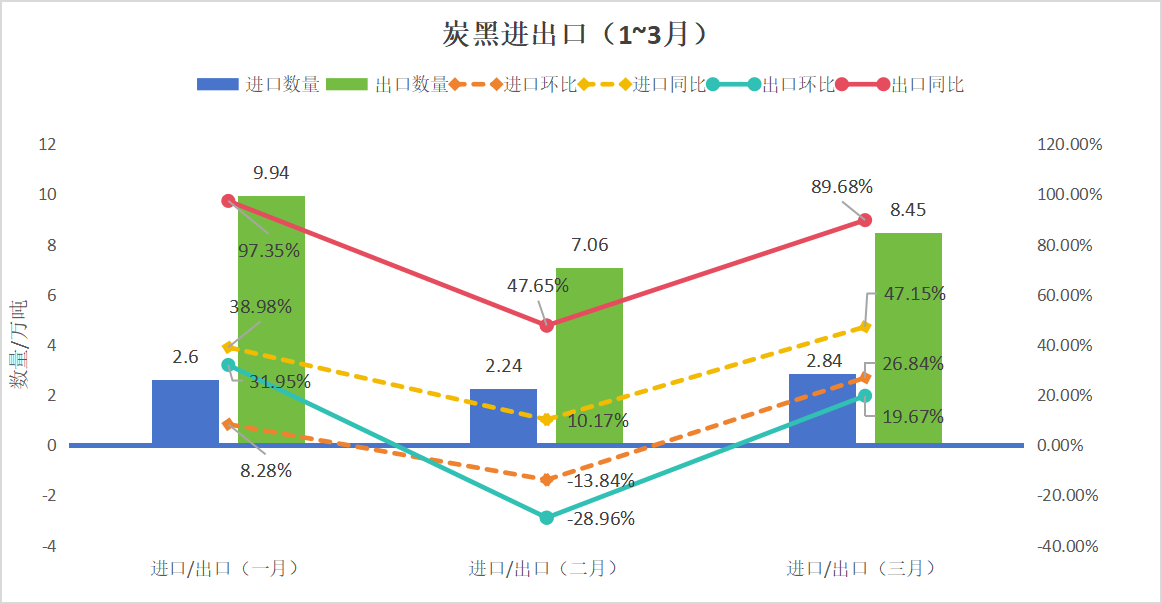

Analysis on the export of carbon black products:

In the first quarter of 2024, carbon black imports totaled 76800 tons, an increase of 31.64 percent over the same period last year, and imports increased by about 18500 tons. At the same time, the export of carbon black also showed a significant increase, with a cumulative export volume of 255000 tons, a surge of 78.3% over the same period last year, and an increase of about 111800 tons.

Carbon black import and export market analysis:

It is worth noting that the export of carbon black has increased by more than 70% compared with the same period last year, fully demonstrating its market vitality. For a long time, China's carbon black has a wide market demand in Southeast Asia, and the main export targets are also concentrated in countries in this region. This year, with the economic recovery of Southeast Asian countries and the rise of international crude oil prices, carbon black using coal tar as raw material in China has shown an obvious cost advantage. The sharp increase in carbon black exports in the first quarter undoubtedly further confirms the rapid growth of the demand for carbon black in the international market, and also highlights the strong competitiveness of Chinese carbon black in the international market. From the perspective of carbon black import market in the first quarter of this year, Russia plays an important role. As Europe adjusts and upgrades the carbon black supply chain to reduce its dependence on Russian raw materials, it has brought unprecedented development opportunities for China. In fact, due to the relatively low price of carbon black in Russia, it has been favored by many downstream manufacturers in China. Last year, the European Union planned to impose a total ban on imports of carbon black and synthetic rubber from Russia from July 2024. Once the ban is implemented as scheduled, the amount of carbon black imported into China from Russia is expected to reach a new peak.

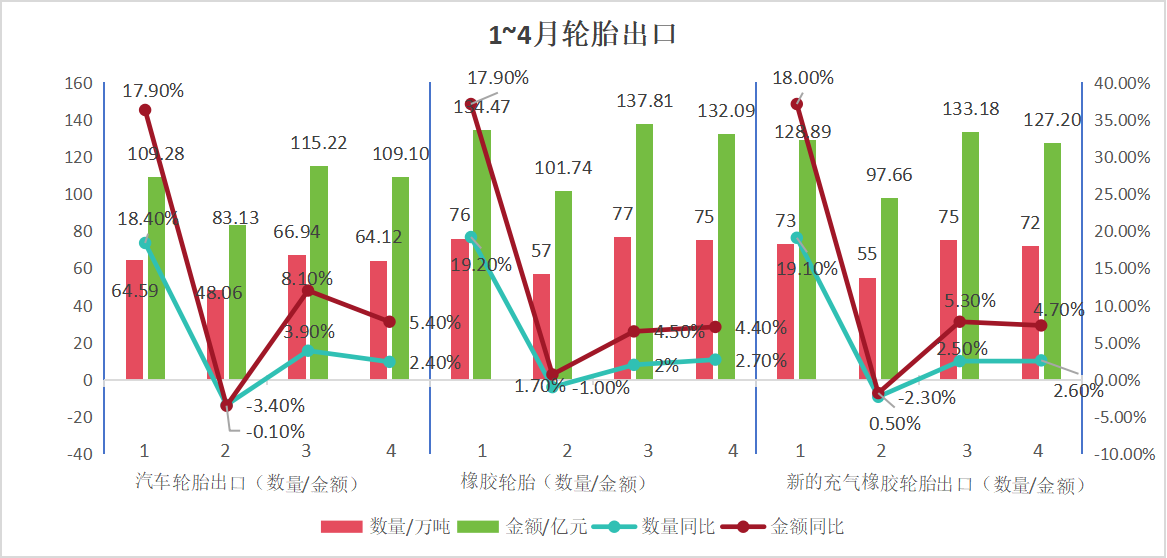

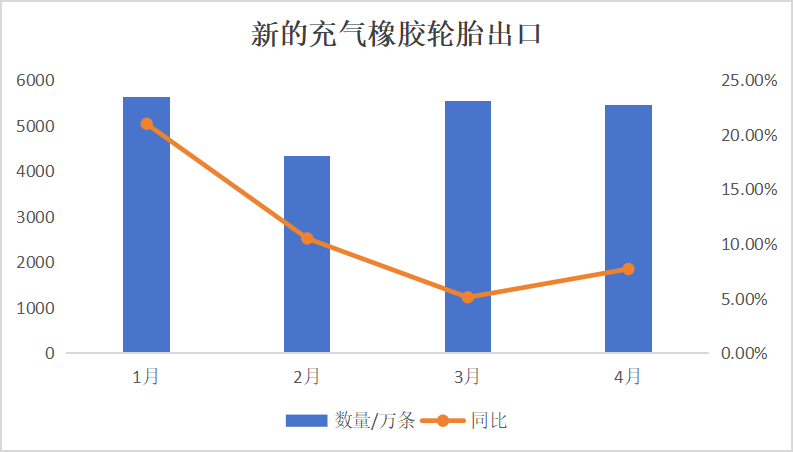

Analysis on the export of tire products:

Total rubber tire exports reached 2.11 million tons in the first quarter of 2024, an increase of 6.7 per cent over the same period last year. At the same time, the value of exports also increased by 4.3% over the same period last year, reaching 52.631 billion yuan. Exports of new inflatable rubber tires reached 2.03 million tons, an increase of 6.5% over the same period last year, while exports totaled 50.621 billion yuan, also an increase of 4.3% over the same period last year. In terms of the number of tires, exports reached 155.14 million in this quarter, a year-on-year growth rate of 12%. Car tire exports also showed a steady growth trend, with exports of 1.796 million tons, an increase of 6.4% over the same period last year, while exports increased to 43.289 billion yuan, an increase of 5.1% over the same period last year.

Tire export market analysis:

China's tire industry showed a strong market performance in the first quarter. Both the volume and value of exports increased year-on-year, although the data fell during the Lunar New year holiday in February due to production suspension and maintenance, but this did not affect the overall growth trend. In the first quarter, the demand for domestic trade in the tire industry gradually recovered, and the demand for foreign trade was also very strong. During this period, the stability of raw material prices and shipping costs is very beneficial to the export business of tire enterprises. Although these costs fluctuate, they tend to be stable on the whole, which provides favorable conditions for enterprises to control costs. In addition, with the recovery of the global automobile industry chain and the recovery of people's travel activities, tire demand is gradually picking up, which further promotes the substantial growth of production and sales of tire enterprises. In such a market environment, many tire companies have achieved excellent performance in the first quarter, and even set a new sales record. Entering the second quarter, with the blessing of the peak season, the tire industry is expected to remain strong.

A list of exports in other sub-areas:

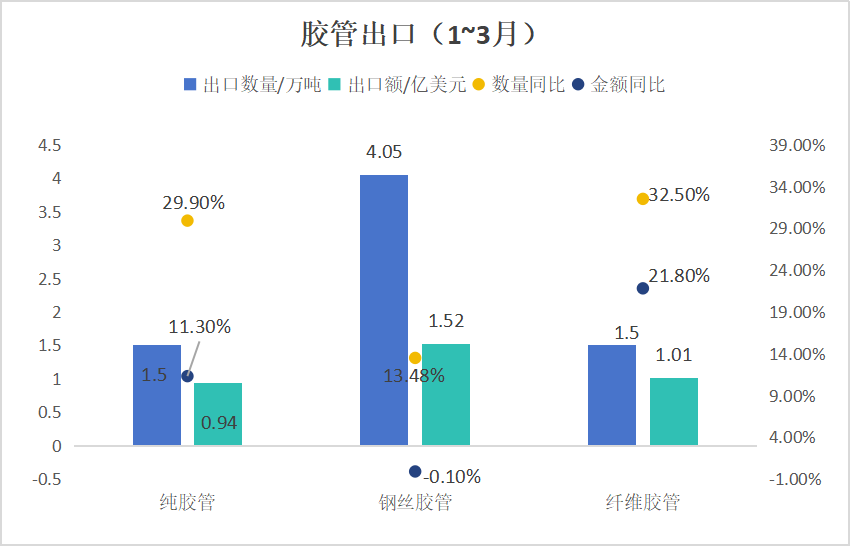

Analysis on the export of hose tape products:

Hose:

In the first quarter of 2024, rubber hose exports totaled 79200 tons, a year-on-year growth rate of 25.3 percent, and total exports increased by 10.4 percent to US $382 million. However, the average export price fell by 11.9 per cent to US $4820 per tonne. Among them, the export volume of pure rubber hose increased by 29.9% over the same period last year to 15000 tons, while the export volume also increased by 11.3% to US $94 million, and the average export price decreased by 14.3% to US $6243 per ton. Exports of steel wire hose also increased by 13.48 per cent to 40500 tons, while exports fell slightly by 0.1 per cent to US $152 million, while the average export price fell 12 per cent to US $3768 per ton. The export volume of fiber hoses increased by 32.5% to 15000 tons, the export volume increased by 21.8% to US $101 million, and the average export price decreased by 8% to US $6647 / ton.

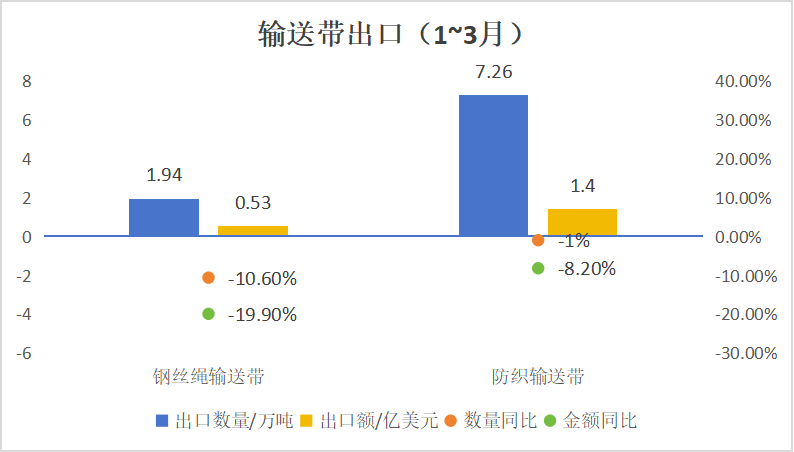

Conveyor belt:

The conveyor belt export market showed a slight downward trend in the first quarter of 2024. The total volume of conveyor belt exports fell slightly by 1.1% to 95700 tons in the quarter. Total exports and average export prices also declined, falling 9.7 per cent and 8.7 per cent, respectively, to US $211 million and US $2203 per tonne. Among them, the export volume of wire rope conveyor belts decreased by 10.6% to 19400 tons, and the export volume and export price also decreased by 19.9% and 10.3% respectively to US $53 million and US $2741 / ton. Exports of textile conveyor belts fell slightly by 1.0 per cent to 72600 tons, while exports and average export prices fell by 8.2 per cent and 9.1 per cent to US $140 million and US $1929 per ton, respectively.

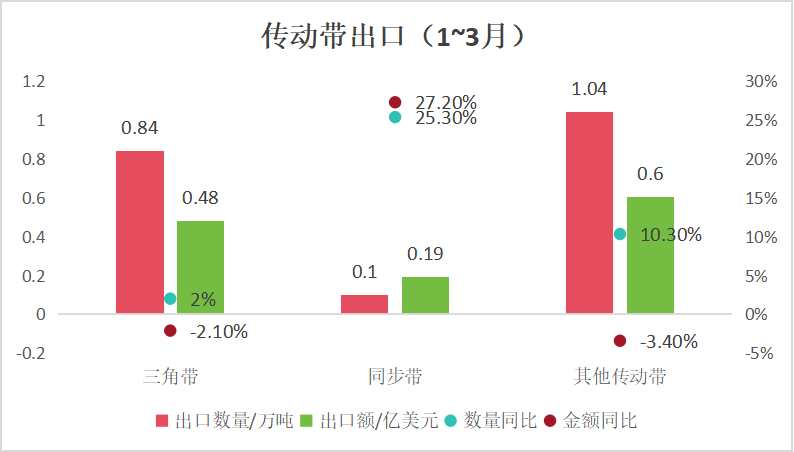

Transmission belt:

In the first quarter of 2024, total belt exports increased by 7.2 per cent to 19900 tons, while total exports also increased by 0.8 per cent to US $126 million. The average export price fell 6.0 per cent to US $6353 per tonne. Among them, the export volume of the triangle belt steadily increased by 2.0% to 8400 tons, but the export volume decreased slightly by 2.1% to US $48 million, and the average export price also fell by 4.0% to US $5649 per ton. The export volume of the synchronous belt increased by 25.3% to 1000 tons, the export volume increased by 27.2% to US $19 million, and the average export price also rose slightly by 1.5% to US $18815 per ton.

A list of the export of each product:

According to the above figure, exports of tires, power tires, hose belts and carbon black industries generally grew year-on-year in the first quarter, with only a slight decline in exports in the conveyor belt industry. On the whole, the export situation of China's tire and rubber industry is improving, which not only lays a solid foundation for the development of the whole year, but also indicates that China's tire and rubber industry will usher in more development opportunities under the background of global economic recovery.