Polyester: Extreme weather takes turns and terminal demand pressure is increasing

Recently, various parts of North China have launched a high-temperature roasting mode. Starting from June 8, high temperatures have developed rapidly in Beijing-Tianjin-Hebei, Henan, Shandong and northern Jiangsu and Anhui. Seven provinces and cities including Beijing, Tianjin and Hebei continue to issue high-temperature orange warnings. This round of high-temperature weather is the high-temperature process with the widest impact and the strongest intensity in the northern region this year. Hebei, Henan, Shandong and other places have a long duration of high temperatures and extreme daily highs. Zhejiang, Jiangxi, Hunan and other places will experience heavy to heavy rains, and many provinces have also issued blue warnings for severe convective weather.

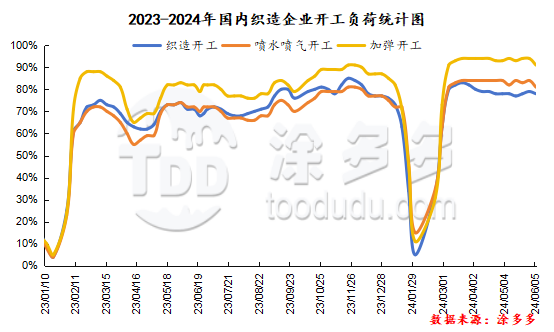

As the country enters midsummer, terminal demand has begun to weaken under the influence of extreme weather such as high temperatures. The off-season atmosphere of the textile market has gradually deepened. Weaving companies are the main source of order production, and there is insufficient follow-up on new domestic and foreign trade orders. Only some companies receive foreign trade autumn and winter orders. Orders are still acceptable, the market is insufficient, and the pressure on factories remains. Coupled with the high cost of raw materials, corporate profits have been compressed, and the overall start-up load of weaving companies is expected to continue to weaken.

Under the pressure of weakening terminal demand, the production and sales of polyester enterprises will continue to face a sluggish situation. The pressure on enterprises 'inventories will gradually increase. The overall start-up of polyester enterprises will remain at around 88%, which is lower than the level of the same period in previous years. In addition, the processing fees of polyester enterprises are low. The company's cash flow is still at a loss, and the company's enthusiasm for starting work is low. Polyester enterprises maintain a continuous production reduction model.

For polyester raw material PTA, with the restart of multiple parking devices and the easing of tight cargo conditions at the port, market supply pressure has increased. Hanbang's 2.2 million-ton PTA unit resumed operation in early June, and the unit was stopped in January 2021. Yisheng New Materials No. 2 3.6 million-ton PTA unit was overhauled on May 15, half of which was restarted on June 5, and the rest was delayed. Pengwei Petrochemical's 900,000-ton PTA unit is about to resume, and the market supply will continue to rise. There are expectations that the PTA supply and demand side will weaken. By then, PTA may change from de-warehouse to de-warehouse state.

Judging from the supply and demand side of polyester raw material ethylene glycol, although ethylene glycol port stocks are still at a low level, with the decrease in port shipments in recent days, stocks in the main port of East China have begun to accumulate slightly. With the restoration of repair units of Zhejiang Petrochemical, Fujian United and Zhongke Refining and Chemical, the ethylene glycol operating rate has rebounded rapidly, market supply expectations have increased, while terminal demand expectations have weakened, and the market supply and demand side is weak, which provides insufficient support for the market.

To sum up, the supply of polyester raw materials has begun to pick up, while demand continues to weaken. The market is expected to accumulate stocks, and the market is under obvious pressure. However, the international crude oil market has become stronger. Recently, as the market's concerns about the OPEC+ production increase plan have been dispelled, positive factors have increased. In addition, the benefits of the summer travel peak in the United States have begun to gradually be released, which has also brought positive support from the demand side. In the short term, international oil prices may gradually recover and recover. Costs support the market. Due to the low processing fee level of various varieties in the polyester industry chain, its own supply and demand drivers are limited, and mainly follow fluctuations on the cost side, the short-term polyester chain may rebound slightly with the increase in costs. Pay close attention to the promotion of international crude oil and market supply and demand to the market.