[Natural Rubber]: Rubber Daily Journal (June 12)

Analysis of natural rubber market price on June 12

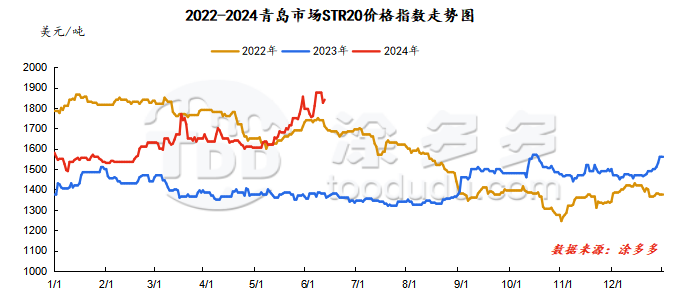

index

On June 12, the STR20 price index of natural rubber in the Qingdao market was US$1840/ton, up 15 or 0.8% from yesterday.

market analysis

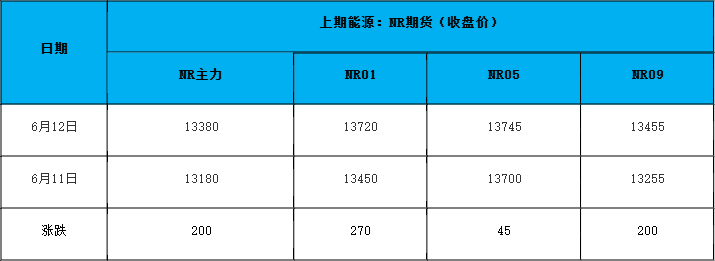

futures market

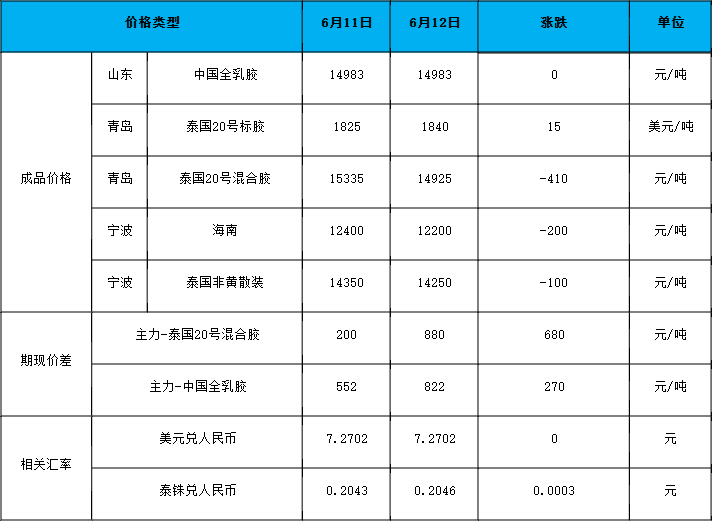

spot market

Supply:

Foreign countries: Thailand's raw material output is low, and market prices are high and volatile.

China: Yunnan's raw material market prices increased slightly, while Hainan's raw material market prices fell sharply.

On the demand side: Semi-steel tire enterprises have basically maintained a high level of start-ups, with some enterprises reaching 90%, and production and sales are still acceptable; the start-up load of all-steel tire enterprises has remained stable, shipments are flat, and inventory reserves are relatively sufficient. In terms of the market, the shipment performance of tire companies fell short of expectations after the holiday season, the terminal demand performance was weak, the liquidity of market supplies was poor, and the inventory pressure on companies remained unchanged.

Futures spot price list

market outlook

While the output of raw materials at home and abroad has increased slightly slowly, the market prices of raw materials have remained high, which has strong support for rubber costs; today, the price of China's natural rubber market has fluctuated and fell, the focus of market transactions has dropped slightly, and the spot supply is relatively tight; the downstream tire industry has not yet fully resumed work and production, terminal needs are not good, and companies are purchasing more on bargain hunting. It is expected that the natural rubber market will operate steadily in the short term.