White sugar: Futures prices have fallen for two consecutive days, bearish sentiment has increased, and the spot market has continued to decline

White sugar: Futures prices have fallen for two consecutive days, bearish sentiment has increased, and the spot market has continued to decline

Analysis of white sugar futures: On June 12, the opening price of SR409 contract was 6211, the highest price was 6211, the lowest price was 6170, the open position was 358621, the settlement price was 6191, yesterday's settlement: 6206, down: 15, daily trading volume: 296880 lots.

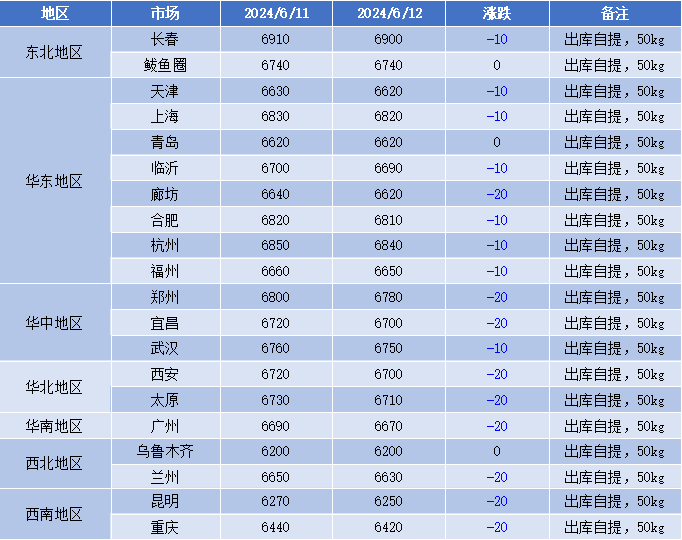

Comprehensive price list by region: yuan/ton

White sugar spot market: The mainstream transaction price in China's white sugar market continued to decline today. Among them, 6,740 - 6,900 yuan/ton in Northeast China, 6,620 - 6,840 yuan/ton in East China, 6,700 - 6,780 yuan/ton in Central China, 6,700 - 6,710 yuan/ton in North China, 6670 yuan/ton in South China, 6,200 - 6,630 yuan/ton in Northwest China, and 6,250 - 6,420 yuan/ton in Southwest China. Quotation of white sugar companies: Quotation of Nanhua Group: Quotation of Nanhua Kunming first-class white sugar is 6320 yuan/ton, down 20 yuan/ton; quotation of Nanhua Xiangyun and Dali first-class white sugar is 6290 yuan/ton, down 20 yuan/ton; quotation of first-class white sugar in Nanhua Yun County is 6260 yuan/ton, down 20 yuan/ton. Nanhua Guangxi first-grade white sugar quoted 6,500 - 6,600 yuan/ton, down 30 yuan/ton. Yingmao Group's quotation: Yingmao Kunming's first-grade white sugar quoted 6320 yuan/ton, down 20 yuan/ton. Yingmao Dali's first-grade white sugar quoted 6280 yuan/ton, down 20 yuan/ton. COFCO (Tangshan) Sugar Co., Ltd. quoted 6720 yuan/ton for imported processed sugar, down 20 yuan/ton.

White sugar market outlook: On the external market, sugar production in central and southern Brazil may decline. Coupled with the rise in crude oil prices overnight, ICE raw sugar futures closed higher on Tuesday. China's white sugar futures prices fluctuated downward at night, while early trading prices remained weak and stabilized slightly in the afternoon. The technical level shows that the opening of the three tracks of the Bollinger Band (13, 13, and 2) has narrowed, and the candle chart shows that the negative column has fallen for two consecutive days. The daily MACD line and KD line continue to show a gold cross trend. The market has slightly reduced its positions and opened more than 18.3% compared with the short opening of 20.9%, which has increased the power of short positions; the prices of sugar companies in the spot market have generally been lowered, and market transactions have been average. Overall, white sugar futures prices are expected to be weak and volatile in the short term.

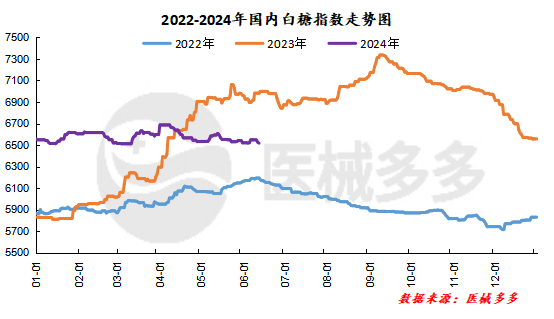

China's white sugar index: According to data from Medical Equipment, China's white sugar spot index was 6,517.57 on June 12, down 10.00, or 0.15%, and the white sugar index was lowered.

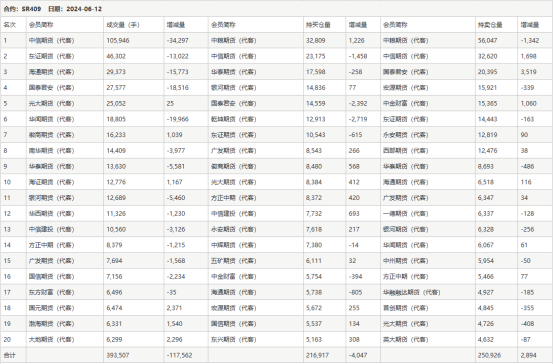

Position Dragon and Tiger List

The information provided in this report is for reference only.

Original: Wang Yaoxin 17732561807