PVC: The futures price may seem magnificent, but in fact, it is narrow and sideways, and the spot is sorted out in a small range

PVC futures analysis: June 14 V2409 contract opening price: 6205, highest price: 6255, lowest price: 6184, position: 824992, settlement price: 6221, yesterday settlement: 6219, up 2, daily trading volume: 1300396 hands, precipitated capital: 3.589 billion, capital outflow: 12.18 million.

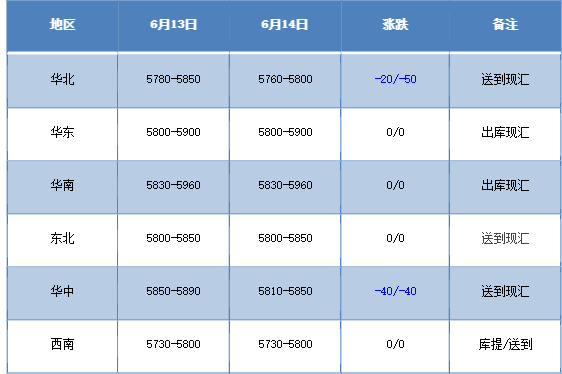

List of comprehensive prices by region: yuan / ton

PVC spot market: mainstream transaction prices in China's PVC market move steadily and slightly, and the overall adjustment range is not large. Compared with the valuation, North China fell 20-50 yuan / ton, East China stable, South China stable, Northeast China stable, Central China fell 40 yuan / ton, Southwest China stable. There is no obvious adjustment in the ex-factory price of the upstream PVC production enterprises, and there are not many contracts signed on Friday. Although the production enterprises still have quotations, the downstream generation of merchants sign fewer orders, and there is a certain wait-and-see mood in the market. The futures market continued to be sorted out in a narrow range, and the spot market offers were not adjusted much compared with yesterday, and adjusted slightly in some areas. At present, the spot market price and point price still coexist, but the transaction is basically biased towards the low point price. Among them, 09 contracts in East China-(300-350-380), 09 in South China-(250-300-350), 09 in North China-(600-630-660), 09 in Southwest China-(430-470). Downstream procurement enthusiasm is general, spot transactions are less.

From the perspective of futures: PVC2409 contract night opening price opened low and high, the futures price showed a certain rising performance, but not strong enough and then down. The V-shaped trend of futures prices fell first and then rose after the start of morning trading, and prices rose to intraday highs in the afternoon and weakened in late trading. 2409 contracts fluctuate from 6184 to 6255 throughout the day, with a spread of 71. 09 contracts reducing positions by 4534 lots, with positions so far of 824992 lots, 2501 contracts closing at 6374, and positions of 124680 hands.

PVC Future Forecast:

In terms of futures: & the volatility of the nbsp;PVC2409 contract futures is still low and narrow throughout the week. First, the volatility range of the futures price is nothing new, and then the low futures price continues to test the bottom range. The technical level shows that the three tracks of the Bolin belt (13, 13, 2) all turn down, showing a certain trend of air-to-air arrangement, and in terms of transaction, it is 24.4% more than that of 23.2% empty. However, due to the narrow horizontal plate of the low position, the distance between the KD lines at the daily level is shortened, so there may be a certain reversal in the market in the future period of time. At present, there are few guidelines from the policy and news aspects, and the market is relatively narrow determined by the fundamentals of supply and demand, so the volatility of futures prices in the short term continues to observe the performance of the low range of 6170-6300.

Spot aspect: recent Chinese commodities did not have more policy stimulus, the early market is nearing the end, commodities began to return to the fundamentals for narrow fluctuations, in the overall mood of a single commodity is more difficult to get out of the separate market, in the plasticizing plate PVC fluctuations once again return to weak. In terms of fundamentals, the price of calcium carbide port is slightly tentatively increased, and the supply of calcium carbide method in PVC production enterprises has been reduced in the near future, while the start-up of ethylene method has resumed, so the change in the overall operating rate is not enough to lead to large price fluctuations. However, in the current weak market, trading began to weaken. In the outer disk, international oil prices rose slightly, supported by OPEC demand growth forecasts and data showing a slowdown in the US labour market and inflation, which raised hopes for a Fed rate cut. On the whole, the spot market is still dominated by narrow adjustment in the short term.