PVC: Futures prices hit a new low. So far, policy gains have been completely reversed, and the spot market weakened at the beginning of the week

PVC futures analysis: June 17 V2409 contract opening price: 6236, highest price: 6244, lowest price: 6126, position: 837449, settlement price: 6191, yesterday settlement: 6221, down 30, daily trading volume: 1381992 hands, precipitated capital: 3.596 billion, capital inflow: 6.71 million.

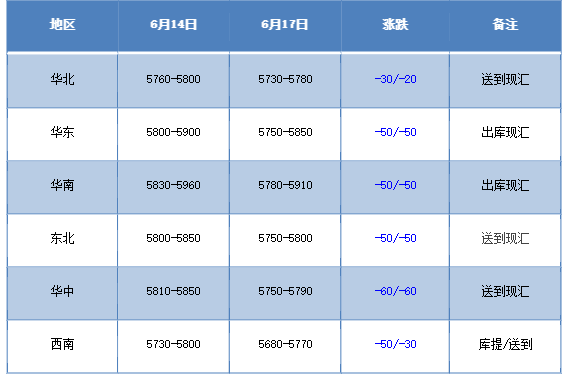

List of comprehensive prices by region: yuan / ton

PVC spot market: mainstream transaction prices in China's PVC market began to weaken at the beginning of the week, and the spot market atmosphere was on the low side. Compared with the valuation, it fell by 20-30 yuan / ton in North China, 50 yuan / ton in East China, 50 yuan / ton in South China, 50 yuan / ton in Northeast China, 60 yuan / ton in Central China and 30-50 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices at the beginning of a partial reduction of 20-50 yuan / ton, in order to promote the transaction, but the weakness of the two cities triggered a wait-and-see mood, in view of the previous part of the high-priced supply, so even if the ex-factory price has been reduced, it has not been exchanged for a better generation of contracts. Futures weakened and fell, and the spot market price was lower than last Friday, and the spot price advantage was relatively obvious after the futures price went down. there was little change in the base difference offer 09 contract in East China-(300-350-380), South China 09 contract-(250-300-350), North 09 contract-(600-630-650), Southwest 09 contract-(430-470). Although the point price is relatively appropriate, but the overall transaction is not much.

From the futures point of view: PVC2409 contract night opening price of a narrow range of volatility, the price is slightly weaker but not obvious. Prices fell after the start of early trading on Monday, with a deep decline and a narrow range of afternoon lows. 2409 contracts range from 6126 to 6244 throughout the day, with a spread of 11809.09 contracts reducing positions by 12457 lots, with 837449 positions so far, 2501 contracts closing at 6284 and 118539 positions.

PVC Future Forecast:

In terms of futures: & nbsp The volatility of the futures price of the PVC2409 contract has refreshed its low, and the futures price has broken the trend from last week's horizontal trading to go down further. Compared with the low point, the decline of the two cities in the current term has completely spit out the overall increase caused by the policy in May, and judging from today's trading trend, the volatility of futures has returned to the market dominated by short positions, in which the short opening of 26.0% is more than 23.1%. And once greatly increased the position in intraday trading. The daily KD line and MACD dead fork trend is obvious, the technical level shows that the Bollinger belt (13, 13, 2) three tracks all turn down, in the short term, the operation of the futures price or further test the low range of 6080-6250.

Spot aspect: after experiencing continuous decline, the two cities have returned to the initial situation where the policy began to rise, and the market has risen and fallen relatively quickly. After the end of the fermentation of policy factors, first of all, PVC returns to the trend of emptiness in the overall plasticizing plate, followed by insufficient supporting variables of fundamentals, and according to downstream feedback, in view of the downturn in real estate, the profit situation of product companies has always been unable to improve, and orders are insufficient. At present, PVC faces strong supply, weak demand and high inventory, which always restricts the long-term trend of the two cities. Although there has been a strong rise with the help of policy, the corresponding decline is also large. Therefore, it lacks the fundamentals of rigid support. In the outer disk, international oil prices closed slightly lower as a survey showed that US consumer confidence deteriorated, but oil prices rose about 4% weekly, and investors assessed robust forecasts for crude oil and fuel demand in 2024. On the whole, the PVC spot market may continue to sort out at a low level in the short term.