Daily Review of Urea: Supply and demand relations are relaxed and market prices are stable (June 19)

China Urea Price Index:

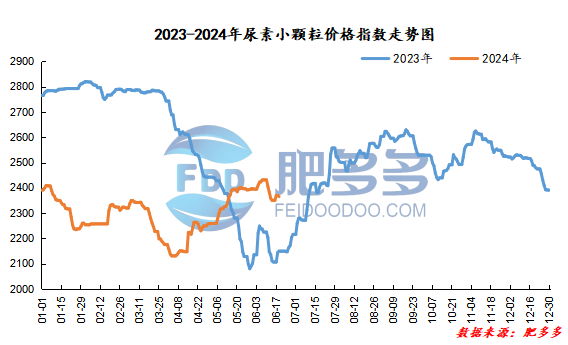

According to calculations from Feiduo data, the urea small pellet price index on June 19 was 2,365.14, a decrease of 4.41 from yesterday, a month-on-month decrease of 0.19% and a year-on-year increase of 10.04%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2076, the highest price is 2088, the lowest price is 2058, the settlement price is 2072, and the closing price is 2060. The closing price is 16 lower than the settlement price of the previous trading day, down 0.77% month-on-month. The fluctuation range of the whole day is 2058-2088; the basis of the 09 contract in Shandong is 200; the 09 contract has increased its position by 3026 lots today, and so far, it has held 216171 lots.

Today, urea futures prices are mainly weak and volatile, and urea's own fundamentals are expected to weaken. Coupled with exchange guarantees to suppress speculation, urea futures prices may still be dominated by weak and logical fluctuations around fundamentals until no new drivers emerge.

Spot market analysis:

Today, China's urea market prices have dropped slightly, and company quotations have mostly remained stable. Currently, there is no good support in the market. With the support of waiting, companies have mostly quoted firm and stable in the short term.

Specifically, prices in Northeast China rose to 2,440 - 2,490 yuan/ton. Prices in East China fell to 2,240 - 2,300 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,240 - 2,460 yuan/ton, and the price of large particles has stabilized at 2,260 - 2,280 yuan/ton. Prices in North China have stabilized at 2,170 - 2,460 yuan/ton. Prices in South China are stable at 2,350 - 2,480 yuan/ton. Prices in the northwest region are stable at 2,380 - 2,400 yuan/ton. Prices in Southwest China have stabilized at 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, there were a large number of orders received in the early stage. Manufacturers continued to implement advance orders mainly. Quotations were held stable and sorted for a short time, and manufacturers had a wait-and-see attitude. In terms of the market, there are no obvious positive factors to stimulate the market. The activity of new orders is average, the price center of gravity has shifted, the sentiment of operators is weak, the overall procurement is regional, and the short-term market is dominated by stalemate and consolidation. In terms of supply, Nissan is operating in fluctuations. The current industry supply is sufficient, equipment continues to recover, and supply is high. On the demand side, demand is in a gap period, and the overall follow-up is slow and inconsistent. Agricultural demand in the northern region is supported, and appropriate follow-up and replenishment is acceptable. The current dry weather has extended the agricultural fertilizer preparation time, and the small amount of procurement follow-up in the northern region is limited; In addition, industrial downstream factories continue to maintain on-demand procurement, with a small amount of follow-up and replenishment, and demand-side purchasing is difficult to support the market conditions.

On the whole, the current supply and demand situation in the urea market is loose, the industry's supply has recovered, and a small amount of demand follow-up is limited. It is expected that the urea market price will remain stable and gradually be slightly lowered in a short period of time.