[Natural Rubber]: Rubber Daily Journal (June 19)

Analysis of natural rubber market price on June 19

index

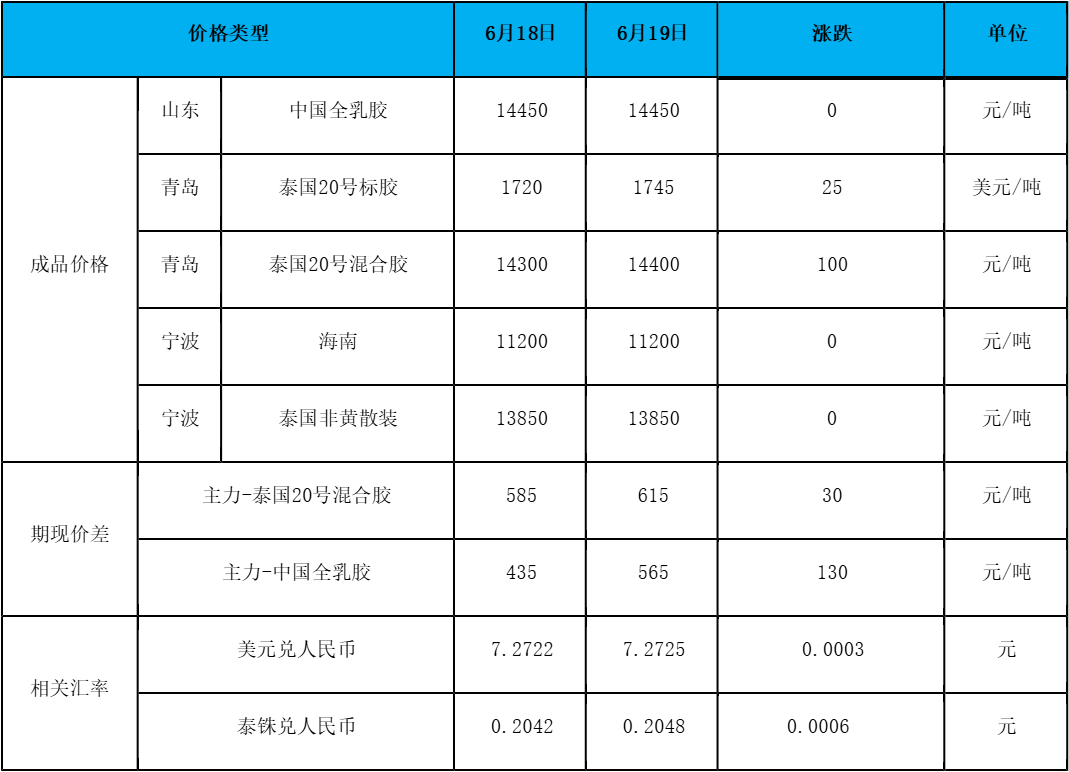

On June 19, the STR20 price index of natural rubber in the Qingdao market was US$1745/ton, up US$25/ton from the previous trading day.

market analysis

futures market

spot market

Supply:

Foreign countries: Thailand has abundant rainfall, and rubber cutting is normal in the northeast. Recently, glue has gradually been produced in the south. However, large factories are rushing to replenish raw materials and deliver early orders. The overall situation is still in short supply. The relative support that raw material prices remain high, but Thailand's production areas are expected to increase. The volume is expected to be relatively obvious, and there is an expectation of dragging prices in the short term.

China: Recent rains and weather in Yunnan production areas have been relatively frequent, which will affect the normal development of rubber tapping in the short term. When the spot market has dropped significantly, weather conditions have certain support for raw material prices.

The current weather conditions in Hainan's production area are still acceptable, and the overall raw materials are in a relatively high volume stage. The support for raw materials is relatively weak. At present, the prices of raw materials entering concentrated dairy mills and those entering full dairy mills are at the same level, and some factories have a trend of switching production.

Demand: Most semi-steel tire companies have started at a high level, and foreign trade continues to be shipped in containers. The overall inventory of the company is slowly increasing. In addition, some companies have currently scheduled a small number of orders for snow tires, and there is still a shortage of regular domestic specifications. Some companies have increased slightly compared with the previous period. In terms of the market, there is no direct positive boost in the terminal market. As the weather gets hotter, the market warms up generally, terminal demand is scarce, and goods are mainly needed.

Futures spot price list

market outlook

This week, the natural rubber market still maintained a volatile correction trend. The total supply of global production areas is expected to increase significantly, and raw material prices have risen to a high level in the early period. As output releases expectations, the expectation of falling raw material prices continues to strengthen. Then from the cost perspective, raw material prices The price support for the main rubber contract has weakened again; On the demand side, there is no direct positive boost in the terminal market. As the weather gets hotter, the market is heating up generally, terminal demand is scarce, and goods are mainly needed. In the short term, the negative factors for rubber will continue to heat up, and rubber prices may remain weak.