[Natural Rubber]: Rubber Weekly Review (June 20)

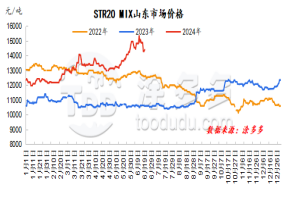

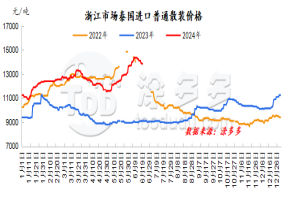

图1:STR20 MIX山东市场价格 图2:浙江市场泰国进口普通散装价格

dry rubber

This week, the natural rubber market still maintained a volatile correction trend. The total supply of global production areas is expected to increase significantly, and raw material prices have risen to a high level in the early period. As output releases expectations, the expectation of falling raw material prices continues to strengthen. Then from the cost perspective, raw material prices The price support for the main rubber contract has weakened again; On the demand side, there is no direct positive boost in the terminal market. As the weather gets hotter, the market is heating up generally, terminal demand is scarce, and goods are mainly needed. In the short term, the negative factors for rubber will continue to heat up, and rubber prices may remain weak.

natural latex

This week, China's concentrated milk offers are also in a slight downward trend. Traders 'enthusiasm for making offers is fair. On the supply side, the supply of the world's major natural rubber producing areas is in a seasonal increase in production, and raw material prices are showing obvious signs of weakening. While the downstream is in the off-season season of seasonal demand, demand-side support remains weak. The market offer prices are relatively chaotic. The price difference between the high-and-low end quotes has widened. The bearish sentiment in the downstream side is fermentation, the willingness to make up for stocks on dips is strong, and the actual transaction in the spot market is still acceptable.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, and the cost support is weakening;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The inventory volume in Qingdao, China may be deposited and removed, and the pressure on high inventory has eased;

4. Exchange rate, Federal Reserve rate hike, etc.