[Natural Rubber]: Rubber Daily Journal (June 25)

Analysis of natural rubber market price on June 25

index

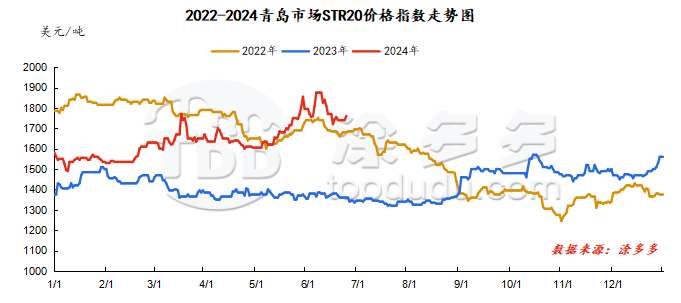

June 25June, Natural Rubber Qingdao Market STR20 Price Index1760 USYuan/ton, compared withThe previous trading day rose by US$20/ton.

market analysis

market analysis

futures market

spot market

Supply:

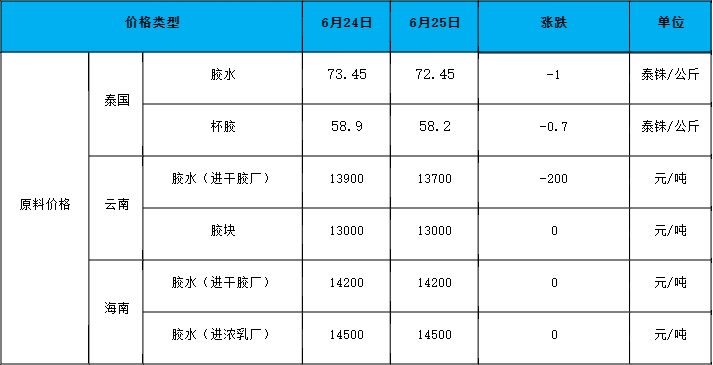

Foreign countries: Thailand has abundant rainfall, and rubber is being cut normally in the northeast. Recently, glue has gradually been produced in the south. However, large factories are rushing to replenish raw materials and deliver early orders. Overall, the supply is still in short supply, and the relative support is that raw material prices remain high.

Domestic: Recent rains and weather in Yunnan production areas have been relatively frequent, which will affect the normal development of rubber tapping in the short term. When the spot market has dropped significantly, the weather conditions have certain support for raw material prices.

The current weather conditions in Hainan's production area are still acceptable, and the overall raw materials are in a relatively high quantity stage, and the support for raw materials is relatively weak. At present, the prices of raw materials entering concentrated dairy mills and those entering full dairy mills are almost equal, and some factories have a trend of switching production.

Demand side:It is understood that at present, most enterprises have started and operated smoothly, and some small-scale enterprises have installed low loads to relieve inventory pressure. The current domestic market shipments have fallen short of expectations, the overall performance has been flat, and the sales pressure of enterprises has further increased. In terms of market, sales of all-steel tires continued to be sluggish. At the end of the second quarter, some factories increased promotional efforts to encourage agents to purchase goods, with the overall effect being average.

Futures spot price list

market outlook

Yesterday, rubber night trading showed a clear upward trend. Today, the daily trading fell within a narrow range. As of the close, Hujiao closed at 15290 yuan/ton, up 2.24%. Recently, due to shipping problems, overseas goods have been seriously stranded in the port, and subsequent arrivals to the port may fall short of expectations. The tight spot liquidity has not yet seen signs of easing. Coupled with the fact that the trend of removing social inventories has not changed, and long-term support has strengthened. In terms of supply and demand, upstream supply is gradually entering a seasonal increase in volume. The sentiment of factories to reduce prices and replenish warehouses is heating up. There is still room for seasonal loosening in raw material prices, which to a certain extent suppresses the rise in rubber prices.