[Natural Rubber]: Rubber Weekly Review (June 27)

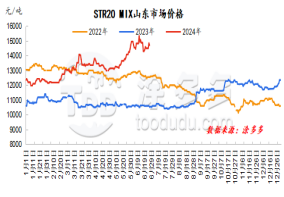

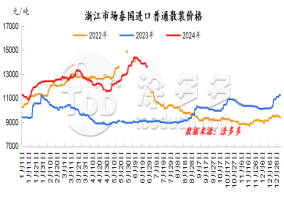

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

This week, the natural rubber market was mixed. At the end of the week, the rubber market rebounded in a narrow range. Rumors of purchasing and purchasing and speculation stimulated significantly. The bullish sentiment in the market retreated rapidly. Yunnan's substitute indicator rubber gradually entered, alleviating the tight supply of domestic rubber to a certain extent. At present, the trend of increasing volume in the main producing areas is obvious. Raw material prices have entered a range of continuous decline. Cost support has weakened, and the increase in supply has triggered market short-term expectations. However, domestic spot circulation turnover is still tight, and short-term coexistence. The rubber disk may maintain a volatile trend.

natural latex

This week, domestic concentrated milk offers are also in a slight downward trend. After excluding the interference of individual weather conditions, the next trend of increasing production in domestic and foreign production areas is basically in a clear state. Recently, raw material prices have also begun to show varying degrees. With the decline, it is not difficult to see that the support on the cost side has begun to weaken. On the demand side, orders for finished products from downstream companies have not improved significantly, and their willingness to purchase demand is low. Coupled with high cost pressure, some factories have begun to reduce start-ups, which in turn slows down the digestion of raw materials and alleviates the current cost pressure. Judging from the supply and demand situation, the price of thick milk is exhausted and difficult to change in the short term.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, and the cost support is weakening;

2、It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3、Inventory levels in Qingdao, China may be deposited and removed, and high inventory pressure has eased;

4. Exchange rate, Federal Reserve interest rate hikes, etc.