[Natural Rubber]: Rubber Weekly Review (July 4)

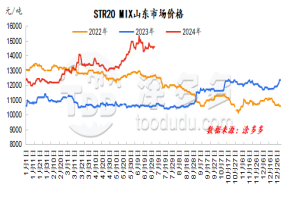

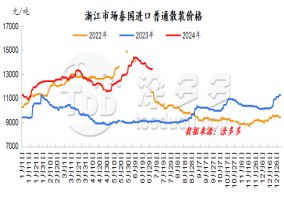

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

This week, the natural rubber market fluctuated within a narrow range. During the seasonal upswing in major domestic and foreign producing areas, the downward trend in raw material prices was obvious, which may have dragged down rubber prices. Coupled with the weak performance of the downstream tire factory replacement market, the market's expectations for the future outlook were short. However, domestic natural rubber stocks maintained a trend of dewarehousing, the decline in raw material prices was getting smaller, and spot prices were firm and difficult to fall. Short-term long-short factors limited, and natural rubber maintained mainly range fluctuations.

natural latex

This week, domestic concentrated milk offers are in a slight downward trend. There are too many spots in the port, and traders are still enthusiastic about offering. Currently, the trend of supply in the world's major natural rubber producing areas is clear. There is an expectation of oversupply in the market. The mentality of the industry is weak and empty. Low-price supplies frequently appear on the market. Downstream product companies maintain the principle of just purchasing, and most of them negotiate under price reductions, and transactions are mainly negotiated on actual orders.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, and the cost support is weakening;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The inventory volume in Qingdao, China may be deposited and removed, and the pressure on high inventory has eased;

4. Exchange rate, Federal Reserve rate hike, etc.。