[Natural Rubber]: Rubber Daily Journal (July 9)

index

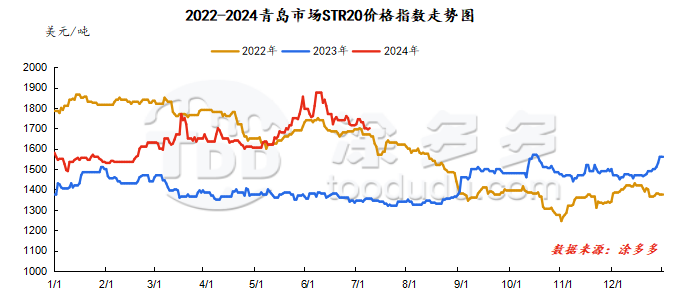

July 9,2007June, Natural Rubber Qingdao Market STR20 Price Index1695 beautifulYuan/ton, compared withThe previous trading day fell by US$5/ton.

market analysis

market analysis

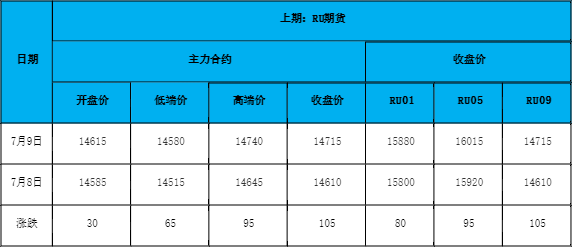

futures market

spot market

Supply:

Foreign countries: Recent rainfall in Thailand's production areas has eased, and raw material prices are still maintaining a downward trend. However, rainy weather is forecast in the near future, and prices rebound within a narrow range.

Domestic: Yunnan's production areas are still disturbed by continuous rainfall. The rainfall has decreased month-on-month, and the output of raw materials has improved slightly. Since the end of June, alternative indicators have gradually entered the production areas in Yunnan, and supply pressure has gradually eased.

The weather conditions in Hainan's production areas have improved, and the rubber tapping work has gradually progressed normally. The daily rubber harvest across the island has returned to normal levels. The glue has temporarily remained stable without significant changes.

Demand side:As of now, most tire companies have continued to have a stable trend, while some all-steel companies have remained at a low level. Sea freight prices in overseas markets such as the Middle East and Africa have declined, but there has been no significant increase in orders. Recently, there has been more rainfall in the domestic market, residents 'transportation and travel have been restricted, and infrastructure start-ups have remained weak. Replacement demand is average, terminal shipments are relatively small. Individual storage promotion policies support sales, but in summary, Look at the domestic market shipments are slow, and corporate sales pressure remains unabated.

Futures spot price list

market outlook

Since natural rubber futures fluctuated and fell last week, the main natural rubber contract has basically remained in a narrow range of around 14600 in the near future.,Long and short news coexist in the entire market,As of now, the seasonal peak production season on the supply side is gradually entering a high-yield period, and the growth in raw material output supply is expected to be obvious. The downward trend in glue prices may continue to maintain the dominant trend, and the support on the cost side is weak. From the perspective of downstream demand, the peak season of the "Golden September and Silver Ten" has not yet arrived. The downstream demand is weak and the operating trend is strong. Coupled with poor start-up in infrastructure, real estate and other industries, the inventory level of rubber tire companies is on the high side. Judging from the supply and demand situation, rubber may continue to weaken in the short term.