[Natural Rubber]: Rubber Daily Journal (July 10)

index

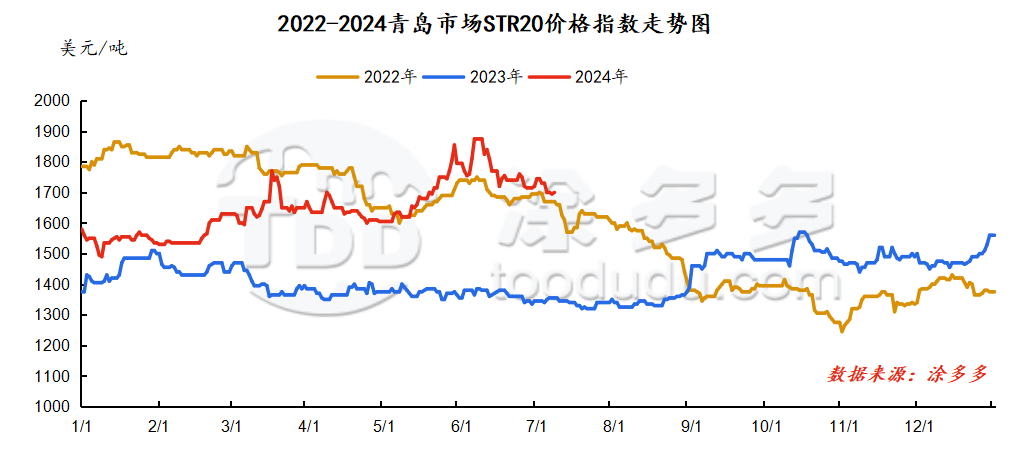

July 10June, Natural Rubber Qingdao Market STR20 Price Index1700 USYuan/ton, compared withStable on the previous trading day.

market analysis

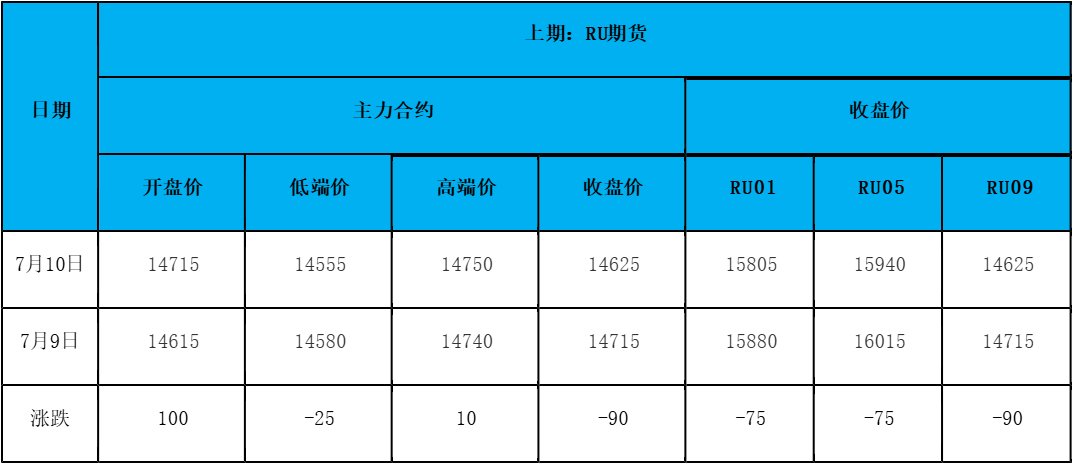

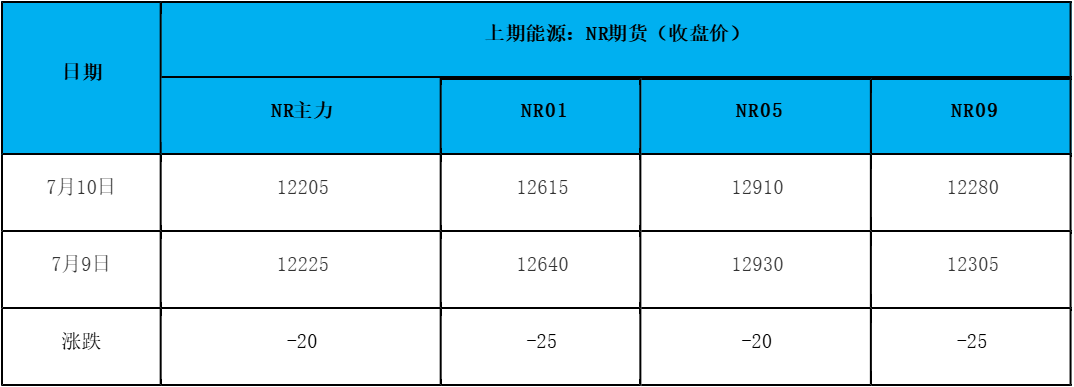

futures market

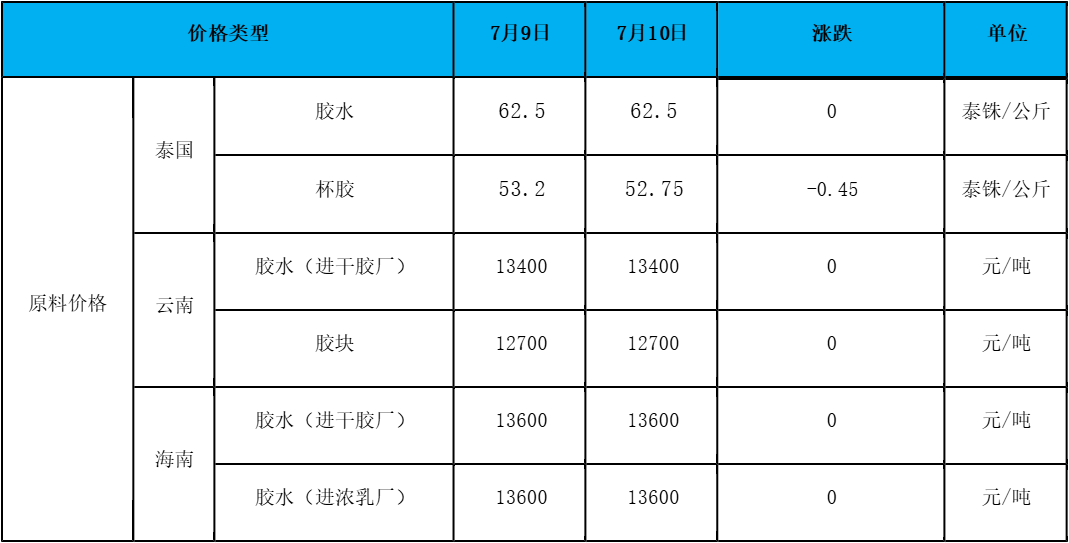

spot market

Supply:

Foreign countries: Recent rainfall in Thailand's production areas has eased, and raw material prices are still maintaining a downward trend. However, rainy weather is forecast in the near future, and prices rebound within a narrow range.

Domestic: Yunnan's production areas are still disturbed by continuous rainfall. The rainfall has decreased month-on-month, and the output of raw materials has improved slightly. Since the end of June, alternative indicators have gradually entered the production areas in Yunnan, and supply pressure has gradually eased.

The weather conditions in Hainan's production areas have improved, and the rubber tapping work has gradually progressed normally. The daily rubber harvest across the island has returned to normal levels. The glue has temporarily remained stable without significant changes.

Demand side:As of now, most tire companies have continued to have a stable trend, while some all-steel companies have remained at a low level. The logistics and transportation industry performed steadily, with lower freight rates and low profits. There was insufficient demand for tire replacement. Replacement demand in the all-steel tire terminal market continued to be sluggish, and customers were cautious when taking goods. Some brands have certain promotions, which will slightly drive shipments and have limited impact on overall replacement demand.

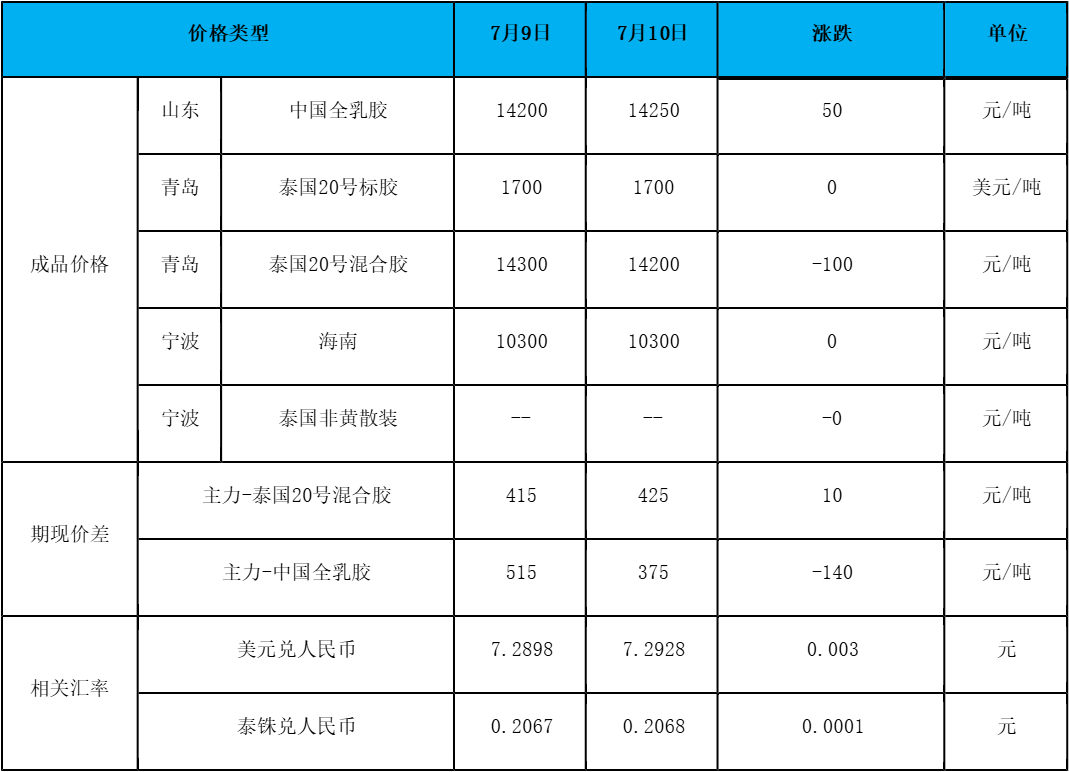

Futures spot price list

market outlook

Rubber prices have basically remained low this week. As of now, the supply side is still the main reason for the continued negative rubber prices. Downstream demand remains weak. Processing plants remain mainly in demand. The continued weakening of the demand side has also caused rubber prices to continue to be under pressure. The domestic automobile industry has entered the seasonal mid-to-off-season, and the supply side is expected to grow strongly. However, shipping problems have led to restrictions on transportation in the logistics link. The amount of imported rubber arriving at the port may not be as expected. The status of port de-warehousing remains, which has alleviated the continued decline in rubber to a certain extent. Trend, short-term natural rubber prices will continue to have limited room for downward growth, or maintain range operation.