[Natural Rubber]: Rubber Weekly Review (July 11)

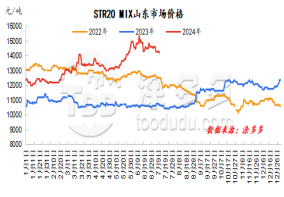

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Rubber prices have basically remained low this week. As of now, the supply side is still the main reason for the continued negative rubber prices. Downstream demand remains weak. Processing plants remain mainly in demand. The continued weakening of the demand side has also caused rubber prices to continue to be under pressure. The domestic automobile industry has entered the seasonal mid-to-off-season, and the supply side is expected to grow strongly. However, shipping problems have led to restrictions on transportation in the logistics link. The amount of imported rubber arriving at the port may not be as expected. The status of port de-warehousing remains, which has alleviated the continued decline in rubber to a certain extent. Trend, short-term natural rubber prices will continue to have limited room for downward growth, or maintain range operation.

natural latex

This week, domestic concentrated milk offers have consolidated within a narrow range, and traders 'enthusiasm for making offers is still good. As concentrated milk prices have fallen, the sentiment of downstream product companies has improved despite the low inventory of raw materials. In addition, the actual purchase price of raw materials in Hainan production areas is on the high side, traders have reduced their willingness to lower prices, offers have stabilized and waited. The downstream inquiry atmosphere is still good, and there are still many discussions on reducing prices.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, and the cost support is weakening;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The inventory volume in Qingdao, China may be deposited and removed, and the pressure on high inventory has eased;

4. Exchange rate, Federal Reserve rate hike, etc.。