[Natural Rubber]: Rubber Daily Journal (July 15)

Analysis of natural rubber market price on July 15

index

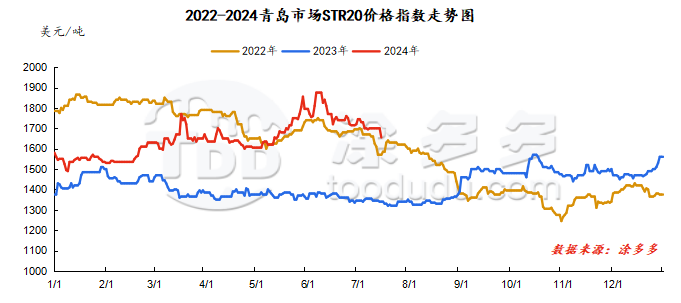

July 15June, Natural Rubber Qingdao Market STR20 Price Index1655 beautifulYuan/ton, compared withThe previous trading day fell by US$45/ton.

market parsing

parsing

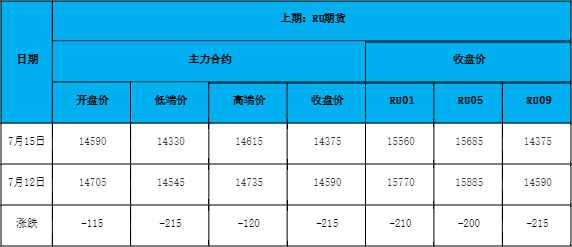

futures market

spot market

Supply:

Foreign countries: Thailand's production areas still have the impact of rainfall, the area opened in the production areas has narrowed, and raw material prices have stopped falling and rebounded.

Domestic: There has been light rain in Yunnan's production areas recently. Due to the influence of market prices and seasonal increases, glue prices have fallen back and stabilized. Dry glue in some processing plants is still in the upside down stage. Replacement indicators have entered in Yunnan's production areas since the end of June, and supply pressure has gradually eased.

Rainfall in Hainan's production area has increased since the weekend, glue output has decreased, and domestic and state-owned glue collection guidance prices have remained stable, but actual glue collection prices have increased within a narrow range.

Demand side:There is insufficient terminal demand, and there is still a shortage of goods in the semi-steel tire market, but the overall impact on shipments has little. Goods are scarce through channels, and they continue to be purchased on demand. Terminal demand for all-steel tires is slow. Some brands have guidance on promotional policies. The downward transfer of products is relatively smooth, but the actual terminal digestion capacity is insufficient.

Futures spot price list

market outlook

Last week, the main rubber contract basically remained at around 14600, and the closing price was 14375 yuan/ton. Recently, the overall start-up situation of downstream product companies has remained relatively stable, but the spot market terminal demand has been slow, and the actual terminal digestion capacity is insufficient. The upstream supply side is in a seasonally strong production season, and raw materials are still expected to be high. However, recent rains have been frequent, and raw material prices have rebounded. There is certain support for rubber prices in the short term, but terminal demand is still insufficient. In the short term, natural rubber prices will continue to have limited room for further downward growth, or maintain a range of operations.