Analysis of natural rubber market price on July 22

index

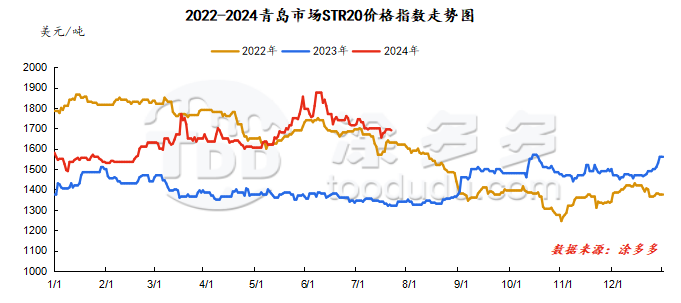

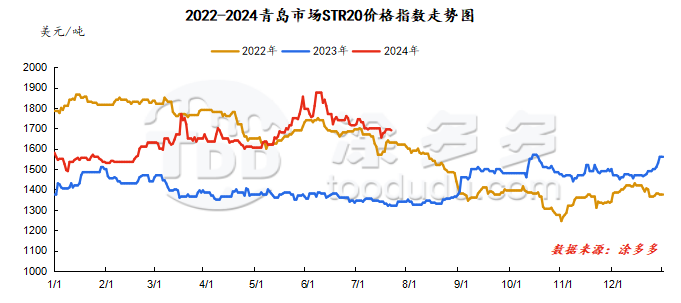

July 22June, Natural Rubber Qingdao Market STR20 Price Index1690 beautifulYuan/ton, compared withThe previous trading day fell by US$5/ton.

market analysis

market analysis

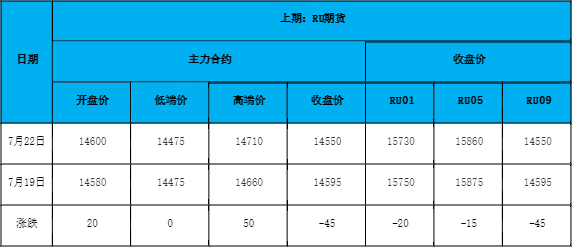

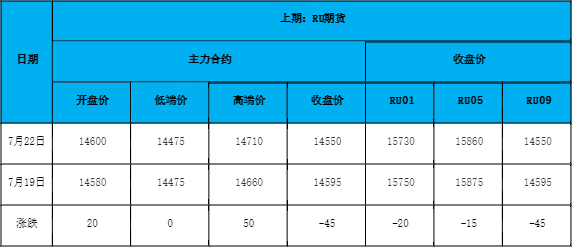

futures market

spot market

Supply:

Foreign countries: There is more rainfall in northeastern Thailand than in the south, and there is still more rainfall overall, which affects the pace of new rubber release. Restocking by secondary suppliers is not smooth, and there is not much room for downside in raw material purchase prices.

Domestic: Currently, Yunnan production has been fully cut, and glue has entered the stage of comprehensive supply. The current glue price is basically stable and there is little room for decline. Later, we will continue to pay attention to the starting level and output of processing plants in the production area.

Typhoon weather landed in Hainan's production area, and the overall precipitation weather was too high. The development and advancement of rubber tapping work were blocked, and the actual purchase price of raw materials continued to rise.

Demand side:Demand in the domestic market is weak, shipments within market channels are slow, and sales in terminal stores have not boosted. However, as the inventory is digested in the early stage, there is a need for replenishment in the market. In order to increase sales, there is some room for negotiation among upstream agents on actual shipments.

Futures spot price list

market outlook

Today, the main rubber contract still maintains a weak consolidation. Recently, due to typhoons and other rainfall in the upstream production areas, the opening of domestic production areas has been blocked, and the output of raw materials has fallen short of expectations. In turn, raw material prices have begun to rise in a narrow range. In the short term, there is still support for the cost side. However, so far, the start-up of downstream product companies has remained weak. Domestic all-steel tires have been sluggish, and the operating rate of semi-steel tires has continued to fall slightly. Shipments of rubber tire companies have slowed down, finished product inventories are high, and rubber panels are trending higher or under pressure. Under weak demand expectations, rubber prices may remain low.

market analysis

market analysis