[Hot Focus]: Frequent weather disturbances, long air and interwoven rubber disk surfaces fluctuate

Recently, the fatigue trend of the rubber market has continued for multiple trading days. The main contract at the beginning of this week is still hovering around 14500. It is basically relatively stable and has very limited fluctuations. Judging from the current upstream and downstream situation of natural rubber, the upstream and downstream support of rubber futures contracts are both in a relatively weak state, with long and short emotions intertwined, and there are no significant fluctuations in the rubber market.

Upstream supply: Typhoon weather has been relatively active recently. Some major natural rubber producing areas such as Thailand and Hainan are within the scope of typhoon activity. Rainfall is relatively frequent, which has hindered the development of rubber cutting operations to a certain extent. In the short term, the purchase price of raw materials has begun to rise. With a high trend, cost-side support has begun to strengthen. However, for natural rubber, most of the weather disturbances are short-term positive news. Currently, the main natural rubber producing areas are in the peak season for rubber tapping. After the rainfall ends, the expected volume in the producing areas will also begin to appear. In the long term, cost-side support still exists. Weakening expectations. Judging from today's raw material prices in Hainan producing areas, a narrow downward trend has begun to appear.

Downstream demand: The frequent rainfall and other impacts caused by recent typhoon weather have blocked the construction of outdoor infrastructure work. The vehicle transportation market is still in a relatively weak state. Terminal stores and maintenance are just in need of replenishment, and actual transactions in the spot market remain weak. The overall shipment pace of all-steel tires is slow, and finished product inventory has been running at a high level. The domestic market is weak, combined with the fall in sea freight prices on some routes, the wait-and-see attitude of overseas customers has intensified, and delayed shipments have increased, which has dragged on the overall shipment volume of the company, and the overall shipment pace of domestic and foreign sales has been slow.

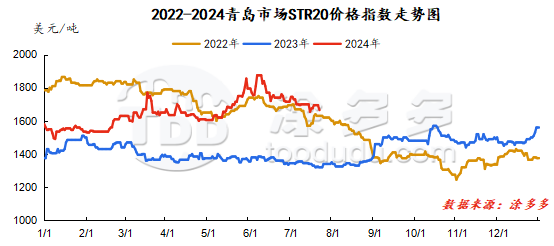

Social inventories: As of last week, China's inventories continued to decline, and Qingdao's inventories continued to be removed. As overseas production areas gradually enter the peak production period and in anticipation of reduced rainfall and weather disturbances, the trend of upstream volume has begun to strengthen, which in turn has pushed up the export situation of rubber-producing countries such as Thailand, and the supply of goods to Qingdao port has increased. From a downstream perspective, tire companies 'all-steel start-ups continue to decline, and overall shipments are less than expected and flexibly scheduled production. It is difficult to stimulate companies' purchasing sentiment to improve. Tire companies continue to purchase raw materials on demand, and Qingdao spot inventory delivery rate began to show a downward trend. If downstream companies start operations and continue in the off-season, the speed of inventory removal in Qingdao may continue to decline.

Outlook for the future: Although there have been weather disturbances such as typhoons in the production area recently, the overall situation is still in a seasonal increase, and the cost side is only short-term support. The off-season for downstream demand is approaching, and the seasonally starting season of all-steel companies has weakened, dragging rubber prices or being limited by the current trading range. It is expected that the short-term natural rubber market will be limited by the current trading range, and rubber prices may continue to be consolidated sideways.