[Natural Rubber]: Rubber Weekly Review (August 1)

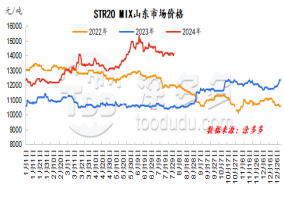

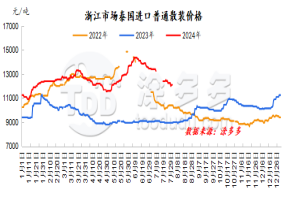

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Rubber prices have basically remained weak and consolidating this week. From the supply side, typhoon disturbance factors have begun to weaken, rainfall and weather have eased, and raw material increase expectations have begun to strengthen. After entering August, supply pressure in production areas has continued to increase, and cost-side support The decline is expected to be stronger. The off-season of downstream demand is approaching, and the seasonally starting season of all-steel enterprises has weakened. The trend of the domestic downstream off-season has not changed. The overall start-up of enterprises has remained weak, and the willingness to purchase raw materials has cooled down. Both supply and demand have difficulty supporting rubber prices. It is expected that short-term natural rubber market is limited by the current trading range, and rubber prices may continue to consolidate sideways.

natural latex

This week, domestic concentrated milk offers basically fluctuated within a narrow range. For a short period of time, the weather at home and abroad is still disturbed. The progress of rubber tapping work is not good. The support of raw materials and costs is strong. Although ships and cargoes arrive in Hong Kong one after another, they are delivered to Hong Kong. Most of the goods are delivered at the port. There are relatively few available spot supplies. Traders intend to hold prices and ship. Downstream product companies maintain the rhythm of replenishing warehouses on demand, and negotiations on actual orders are the main focus.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, and the cost support is weakening;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The trend of inventory removal in Qingdao, China remains unchanged, but the speed of removal may slow down;

4. Exchange rate, Federal Reserve rate hike, etc.。