[Natural Rubber]: Rubber Daily Journal (August 6)

Analysis of natural rubber market price on August 6

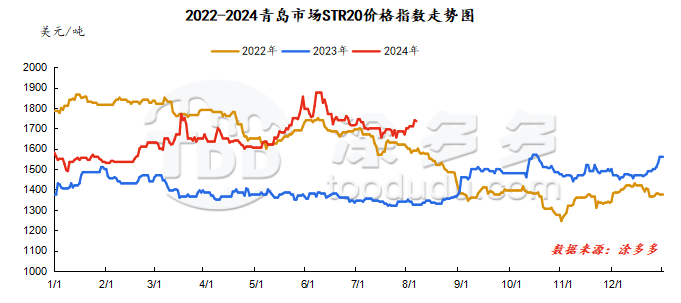

index

August 6June, Natural Rubber Qingdao Market STR20 Price Index1735 beautifulYuan/ton, compared withThe previous trading day fell by US$5/ton.

market analysis

market analysis

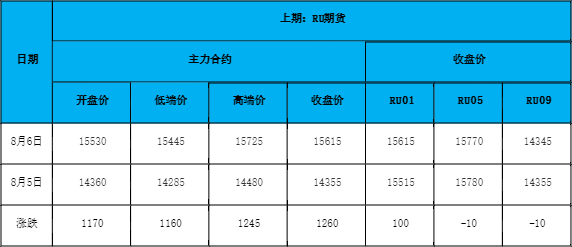

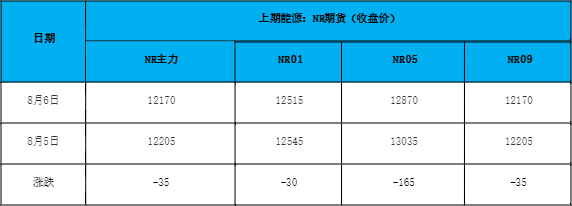

futures market

spot market

Supply:

Foreign countries: There is more rainfall in northeastern Thailand than in the south, and there is still more rainfall overall, which affects the pace of new rubber release. Restocking by secondary suppliers is not smooth, and there is not much room for downside in raw material purchase prices.

Domestic: Currently, Yunnan production has been fully cut, and glue has entered the stage of comprehensive supply. Recently, there has been frequent rainfall in the production area, less glue has been collected, and raw material prices have stabilized.

Typhoon weather in Hainan's production areas has eased, raw materials are expected to be stored, and the actual purchase price of raw materials has dropped within a narrow range.

Demand side:The overall shipment performance is average, and the performance of new orders within the month is differentiated. However, in order to meet customer needs, short-term construction will still be maintained. In terms of the market, terminal demand performance at the beginning of the month is average, and the overall digestion of pre-period inventory is mainly concentrated. It is heard that some companies reserve certain promotional policies for different products, and the overall effect is average.

Futures spot price list

market outlook

Recently, the main rubber contract has experienced a correction, and the short-term end has a narrow fluctuation trend in the early period. Upstream supply pressure still exists. Expectations for raw material increase have begun to strengthen. After entering August, expectations for a decline in cost-side support have strengthened. The off-season for downstream demand is approaching, and the overall start-up of enterprises remains weak. The overall data is still in a dismal state. The willingness to purchase raw materials has cooled down. The social inventory of natural rubber may continue to accumulate. In the short term, natural rubber is still in a supply and demand pattern where supply is less than demand. Support for continued recovery is slightly weak, and may continue to maintain a volatile trend in the short term.