[Hot Focus]: Can rubber continue to rise when the road to shock is over?

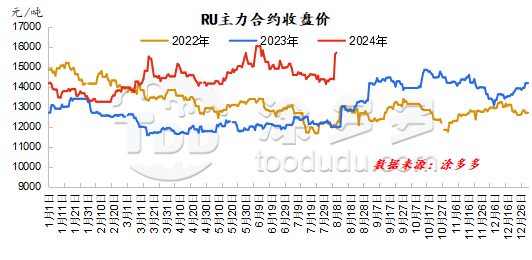

This week, the main contract of natural rubber ended the concussion trend of nearly a month. Under the relatively negative macro environment, the main force of rubber showed an obvious trend of warming and rising, and the price of the main contract rebounded to about 15000 yuan / ton. for rubber, which hovered around 14400 in January, the short-term rebound undoubtedly brought layers of ripples to the calm rubber market.

Macro:According to data released by the China Federation of Logistics and Purchasing on August 6th, the global manufacturing PMI in July 2024 was 48.9%, down 0.6% from June and below 50% for four consecutive months. With the change in the composite index, the global manufacturing PMI remained below 50 per cent, and the decline expanded from last month, ending the operating trend of more than 49 per cent in the first half of this year to below 49 per cent, indicating that the momentum of the global economic recovery continues to weaken and downward pressure has increased. From a subregional point of view, the momentum of manufacturing recovery in Europe and the Americas is relatively weak; the recovery of manufacturing in Asia is relatively stable; and the recovery of manufacturing in Africa has rebounded. The pace of domestic economic recovery slowed, with domestic manufacturing PMI falling to 49.4% in July, below the bust line for three months in a row. The weakening of domestic economic momentum, superimposed downstream into the traditional consumption off-season, the marginal downward demand of the non-ferrous metal industry, the accumulation of major non-ferrous metal varieties, and the prosperity of the non-ferrous metal industry has fallen at a high level. The macro environment at home and abroad has brought a lot of pressure to the whole market, and the bearish mood of the whole commodity market is still in a relatively strong state.

Supply:There is still a strong disturbance in the rainy weather in Thailand, a foreign producing area, and several countries such as India concentrated on the purchase of tobacco rubber, with an increase of 9.86% in raw film, further driving up the overall price of raw materials. The rainfall weather in Vietnam's producing areas is still affected, but the overall output is in the seasonal stage, the current raw material output is still less than expected, there is a certain mood of grabbing raw materials among processing plants, and the purchase price of raw materials rises slightly, superimposed by the increase in the exchange rate of Vietnamese dong, and the export cost of processing plants increases. Import costs remain high, while frequent rainfall in the domestic producing area of Yunnan has led to the infection of some rubber trees. It is understood that recently, the leaves of rubber trees have fallen in Jinghong and other areas, and some rubber forests in the main producing areas have stopped cutting. To a certain extent, the price of glue will be affected. Recently, due to the strong inquiry in the spot market of thick milk, Hainan has relatively driven the purchasing enthusiasm of processing plants, even if Hainan is now in a state of strong production, it is difficult to avoid the continuous rise of raw material prices. According to the current situation of domestic and foreign production areas, the short-term support is strong, but the supply is expected and exists in the peak production period, and there is still a downside risk in the medium and long term.

Demand:The terminal demand of all-steel tires is weak, the shipping pressure of factories and channels is not reduced, and the overall performance of market prices is still weak. In terms of semi-steel tires, domestic demand was flat, sea freight prices fell during the month, and some overseas customers chose to wait and see, and the delivery pace slowed to a certain extent. In order to boost sales, some enterprises reduced prices and promoted some patterns, and market prices loosened.

Inventory:Qingdao warehouse spot inventory is a small accumulation of inventory. The trend of supply in the production area remains unchanged, the actual demand in the lower reaches is weak, and the social inventory begins to show the trend of accumulation. At present, it remains to be seen whether the accumulation of stocks can be sustained.

Forecast:In the short term, the favorable support of the natural rubber market is relatively weak, and the continuous driving force is insufficient. At present, raw material prices are rising due to the influence of demand and rainfall. After Rain Water alleviates and Yunnan deciduous disease improves, the upward space of raw material purchase price is limited. Downstream foreign trade orders slowed down, production scheduling stored signs of decline, overall, the fundamental supply and demand situation does not support a further rise in the short-term Tianjiao market.