[Natural Rubber]: Rubber Weekly Review (August 15)

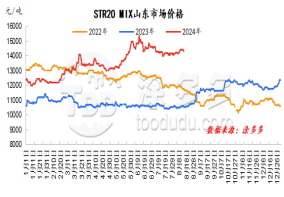

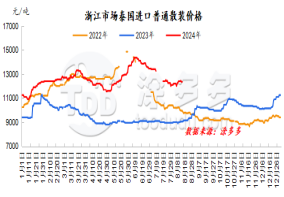

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Rubber prices have warmed up this week, and the bull sentiment in the rubber market has warmed up significantly. Rubber futures prices have remained fluctuating in a relatively high range. So far, the rainfall in northeastern Thailand in the upstream producing area is significantly higher than that in the south, and the overall precipitation is abundant. This meteorological condition has a significant impact on the output rhythm of new rubber, leading to a slowdown in the market supply rhythm. Yunnan's production areas have fully entered the rubber tapping season. However, frequent rainfall has caused certain interference to production, and even fallen leaves have occurred in some areas, exacerbating supply constraints. There is support for upstream prices, the trend of increasing volume during the peak period still exists, and there are also expectations for rubber discs. Downstream start-ups have basically remained relatively stable, and some maintenance companies have resumed construction one after another. However, the overall shipment performance is average, and the performance of new orders within the month is differentiated. However, in order to meet customer needs, short-term start-ups will remain, and may continue to remain strong in the short term. Volatility trend.

natural latex

This week, the price of offers in the domestic concentrated market rose steadily, and traders 'enthusiasm for offers was moderate. The purchase price of raw materials in the Hainan production area rose. With the support of costs, the processing factory raised the factory's self-raised price. There was no pressure on the spot supply in the sales area. The goods holders followed suit mainly, but downstream product companies lacked confidence in the market for finished products in the future. The market trading atmosphere was light, and transactions were maintained under real order negotiations.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, but rainfall disturbances increase, which should continue to pay attention;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. Inventory volume or accumulation trend in Qingdao, China;

4. Exchange rate, Federal Reserve interest rate hikes, etc.