Analysis of natural rubber market price on August 19

index

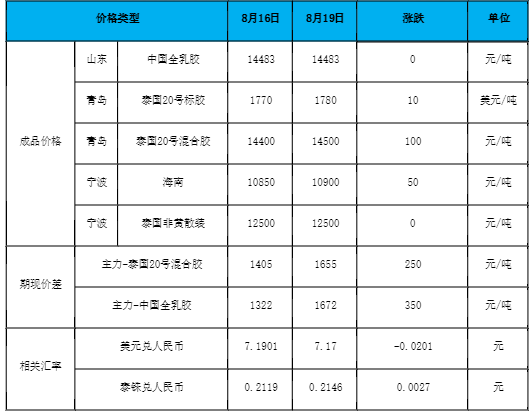

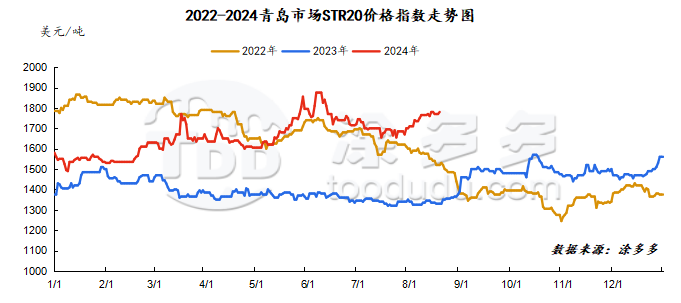

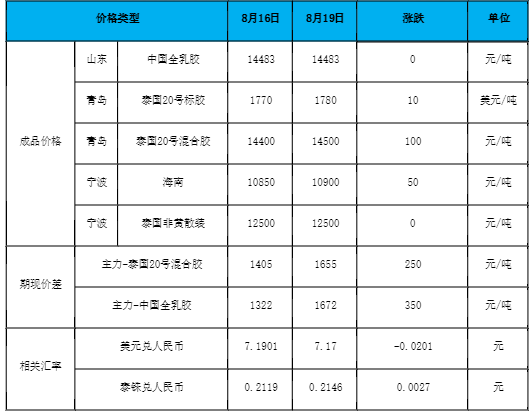

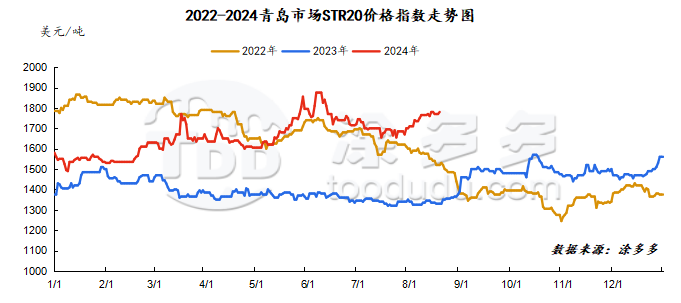

August 19June, Natural Rubber Qingdao Market STR20 Price Index1780 USYuan/ton, compared withThe previous trading day rose by US$10/ton.

market analysis

market analysis

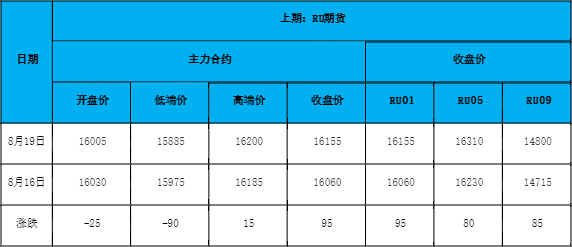

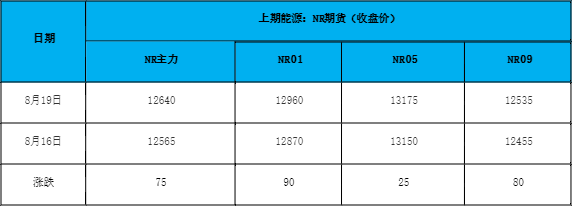

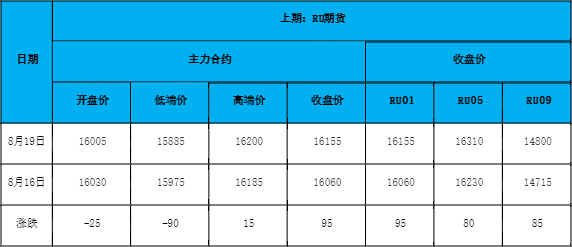

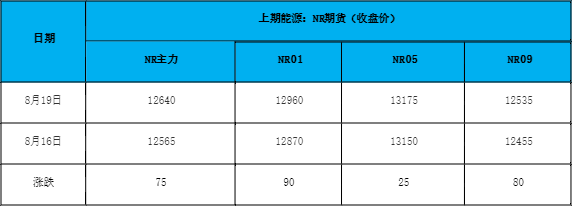

futures market

spot market

Supply:

Foreign: Precipitation in southern Thailand is still in a high trend, disrupting rubber tapping work in some areas, and the overall supply shows a small month-on-month increase. However, as the rainfall eased, the amount of raw materials was significantly increased. As the demand for overseas replenishment cooled, there was room for reduction in raw material prices.

Domestic: Currently, Yunnan production has been fully cut, but there are frequent rains and weather, falling leaves have occurred in some areas, and raw material prices have shown a narrow upward trend.

The weather in Hainan's production areas has eased, the amount of raw materials stored is expected, and the actual purchase price of raw materials has not changed significantly yet.

Demand side:Recently, the operating utilization rate of some all-steel tyre maintenance companies has gradually recovered, but there are still some all-steel tyre companies that have maintenance plans, which has a certain drag on the overall operating rate. In terms of the market, market transactions were flat, offer prices within the channel were stable, and actual transaction volume was average. Some products in the market were sold off at low prices, which had a certain impact on regular channel sales. Demand has not improved significantly, and industry operators 'bullish expectations for sales have weakened.

Futures spot price list

market outlook

Today's main rubber contract continued its previous rise and once again rose above 10,000. So far, the rainfall in Thailand in the upstream producing areas has not been limited alleviated, and the output of raw materials still has an impact. Yunnan's production areas have fully entered the rubber tapping season. However, frequent rainfall has caused certain interference to production, and even fallen leaves have occurred in some areas, exacerbating supply constraints and supporting upstream prices. The operating utilization rate of downstream maintenance companies has gradually recovered, but the overall shipment performance is average and the performance of new orders is differentiated. However, in order to meet customer demand, the start-up is expected to improve slightly in the short term, which will boost the demand for natural rubber to a certain extent, and then in the short term. Support for rubber has a strong upward momentum.

market analysis

market analysis