[Natural Rubber]: Rubber Weekly Review (August 22)

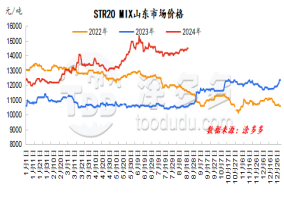

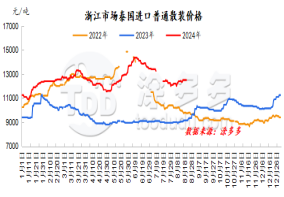

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Rubber prices continued to rise this week. So far, rainfall in Thailand in the upstream producing areas has not been limited alleviated, and raw material output still has an impact. Yunnan's production areas have fully entered the rubber tapping season. However, frequent rainfall has caused certain interference to production, and even fallen leaves have occurred in some areas, exacerbating supply constraints and supporting upstream prices. The start-up utilization rate of downstream maintenance companies has gradually recovered, but the overall shipment performance is average and the performance of new orders is differentiated. However, in order to meet customer demand, the start-up is expected to improve slightly in the short term, which will boost the demand for natural rubber to a certain extent. In terms of inventory, the current pressure is still relatively high, and the overall destocking continues, but the speed needs to be improved. The market has long and short signals, and rubber prices continue to fluctuate mainly.

natural latex

This week, the offer prices in China's concentrated market were relatively stable with limited fluctuations. Traders were more enthusiastic in making offers. The futures market continued to move upward, boosting market sentiment. Spot resources in the short-term sales area have not been fully replenished. Merchants 'offers performed strongly. However, among them, the shipment of concentrated milk in Thailand was relatively poor. The small price reduction of sellers promoted shipment. Downstream product companies had a strong wait-and-see attitude, weak inquiries, and actual orders were negotiated.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, but rainfall disturbances increase, which should continue to pay attention;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The trend of inventory removal in Qingdao, China may ease;

4. Exchange rate, Federal Reserve interest rate hikes, etc.