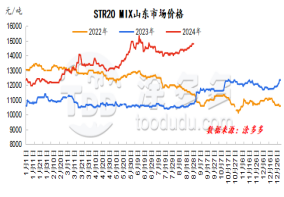

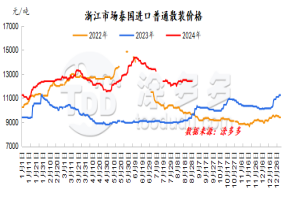

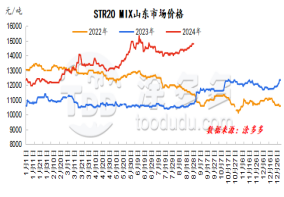

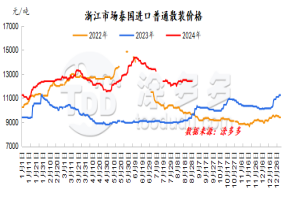

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Rubber prices continued to rise this week. During this period, the high-end price of the main contract even reached 16500 yuan/ton. Judging from the current supply and demand situation, due to weather and other reasons, the overall cutting situation in China's main natural rubber producing areas fell short of expectations, which supported the current raw material prices remain high. However, terminal demand is insufficient, the delivery of goods through channels is slow, the supply of goods is sufficient, and the mood to continue to buy goods is low. They are bearish on the future market, and are conservative in purchasing goods and purchasing on demand. Downstream demand is limited, which provides insufficient support for the continued rise of rubber. Overall, rubber has continued to operate in shock recently, and there is certain pressure for upward fluctuations.

natural latex

This week, the offer prices in China's concentrated market showed a higher trend at the end of the week. Near the end of the week, the futures market was running strongly, which boosted the overall atmosphere of the concentrated milk market. For a short period of time, disturbed by weather and other factors, the upstream raw materials and cost market showed an upward trend. In addition, the arrival of ships and cargo at Chinese ports is still relatively small, and the supply of spot resources on the site is not much. Holders are reluctant to sell and increase their prices. However, downstream product companies are resistant to high prices. The inquiry atmosphere is general, and the transaction maintains real order negotiations.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, but rainfall disturbances increase, which should continue to pay attention;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The trend of inventory removal in Qingdao, China may ease;

4. Exchange rate, Federal Reserve interest rate hikes, etc.