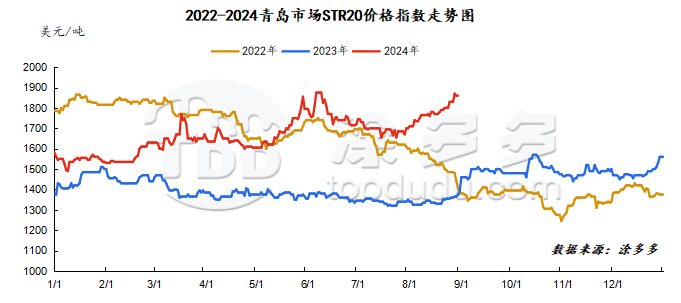

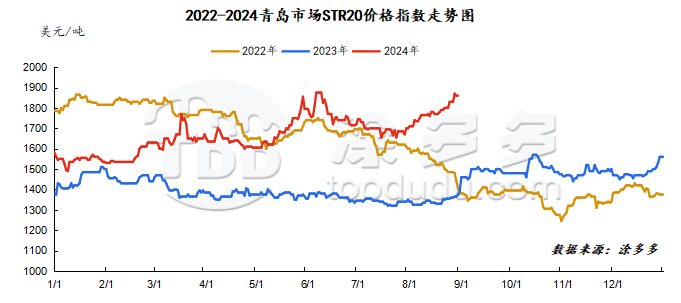

Analysis of natural rubber market price on August 30

index

August 30June, Natural Rubber Qingdao Market STR20 Price Index1860 beautifulYuan/ton, compared withStable on the previous trading day.

market analysis

market analysis

futures market

spot market

Supply:

Foreign countries: Recently, the demand for cigarette chips from overseas tire factories is still there. Coupled with the recent strong monsoon weather throughout southern and eastern Thailand, some rubber gardens have been severely affected. There is a shortage of raw materials in southern Thailand. Factories have saved high prices to rush to replenish stocks. Thai raw material prices have risen throughout the cycle.

China: The rainfall in Yunnan's production areas has decreased slightly, and it has gradually entered the rubber harvest stage. However, due to multiple factors such as the supply of raw materials and the upward trend of the market, the price of glue has increased.

The weather conditions in Hainan's production areas are good, and precipitation still fluctuates in some areas, but the impact on the overall rubber tapping work is relatively limited, and raw material production maintains a seasonal increase trend.

Demand side:It is understood that the overall inventory performance of the company is currently differentiated, and the inventory of all steel tire companies is high. In order to control inventory growth, the phenomenon of enterprises controlling production continues, and semi-steel tire companies are in a state of slow improvement. However, due to the large number of specifications, some companies have insufficient production capacity and supply is tight. In terms of the market, tire agents have sufficient inventory, and are currently not willing to continue to hoard goods. They mainly complete more tasks for the month. At present, the overall inventory is relatively sufficient, and the downstream sentiment is not high, and they mainly buy as they go.

Futures spot price list

market outlook

Today, the main rubber contract has ended its upward trend, and the market has begun to show a narrow correction trend. Judging from the current supply and demand situation, there has been no significant change. Due to the impact of rainfall and weather in the main natural rubber producing areas outside China on the supply side, raw material prices may remain high, which may support the strong volatility of the natural rubber market in the short term. However, terminal demand is insufficient, and tire agents have sufficient inventory. Currently, they are not willing to continue to hoard goods. They mainly complete more tasks for the month. At present, the overall inventory is relatively sufficient, and the downstream sentiment is not high, and they are mainly used and purchased as they are used. Overall, without significant fundamental changes, rubber has continued to operate in shock recently, and there is certain pressure for continued upward fluctuations.

market analysis

market analysis