[Natural Rubber]: Rubber Daily Journal (September 4)

Analysis of natural rubber market price on September 4

index

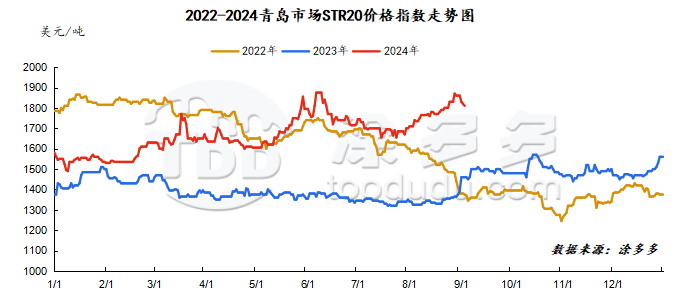

September 4June, Natural Rubber Qingdao Market STR20 Price Index1810 beautifulYuan/ton, compared withThe previous trading day fell by 10 yuan/ton.

market analysis

market analysis

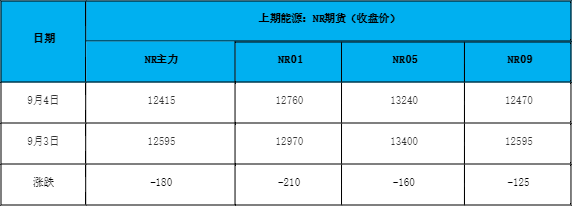

futures market

spot market

Supply:

Foreign countries: Recently, strong monsoon weather has penetrated southern and eastern Thailand, and some rubber plantations have been severely affected. There is a shortage of raw materials in southern Thailand. Factories have saved high prices to rush to replenish warehouses. Thai raw material prices have remained firm at high levels.

China: Rainfall in Yunnan's production areas has decreased slightly, and it has gradually entered the glue collection stage. Glue output has improved, and raw material prices have eased slightly.

The weather conditions in Hainan's production areas are performing well, and precipitation is still repeated in some areas, but the impact on the overall rubber tapping work is relatively limited. Raw material production maintains a seasonal increase trend. However, due to recent typhoon weather, the actual rubber harvest price remains high.

Demand side:It is understood that the current overall production scheduling performance of semi-steel tire enterprises is relatively stable. Supported by snow tires and foreign trade orders, short-term start-ups remain at a high level. At present, during the concentrated production period of snow tires, there are many specifications and models, and some enterprises are out of stock. In terms of the market, the terminal demand for semi-steel tires is still performing well, and most of them are just needed to ship goods. Market prices are mostly stable. The terminal market purchases on demand, and agents 'inventory is relatively sufficient. Due to the sparse delivery channels, the agents' purchasing prices are cautious.

Futures spot price list

market outlook

Today, the main rubber contract continues to maintain a correction trend, but it is still maintained at around 16000 yuan/ton. Overall, the demand side is slowly developing better. Currently, the natural rubber season is booming, and the output of raw materials has improved. China's foreign raw materials prices have declined to varying degrees, and supply-side support has begun to weaken. Coupled with Qingdao's inventories continue to fall, the decline has increased significantly. The market is still dominated by de-warehousing, and social inventories have begun to be de-warehousing. In the short term, the fundamental changes of natural rubber will be relatively limited, and the rubber correction trend will be relatively alleviated.