210

September 11, 2024, 4:19 PM

Analysis of natural rubber market price on September 11

index

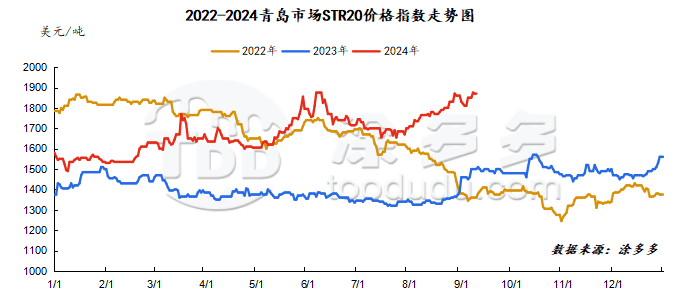

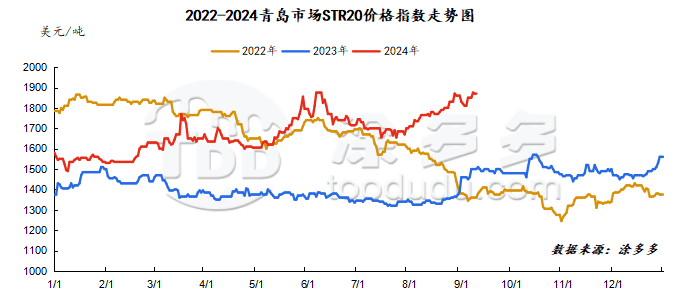

September 11June, Natural Rubber Qingdao Market STR20 Price Index1870 beautifulYuan/ton, compared withStable on the previous trading day.

market analysis

market analysis

futures market

spot market

Supply:

Foreign countries: Recently, strong monsoon weather has penetrated southern and eastern Thailand, and some rubber plantations have been severely affected. There is a shortage of raw materials in southern Thailand. Factories have saved high prices to rush to replenish warehouses. Thai raw material prices have remained firm at high levels.

China: Typhoon "Capricorn" arrived in Yunnan producing areas, which had a great impact on Mengla County. Heavy rains continued, and some processing plants have entered a state of shutdown, production, wind and flood resistance, and the price of rubber collection is not yet available.

Due to the impact of typhoon weather in Hainan's production area, rubber tapping operations across the island have resumed one after another. The actual rubber price of the processing plant has remained high, but the overall rubber collection volume is relatively limited.

Demand side:The operating rate of most semi-steel tires remains high, and some companies concentrate on producing foreign trade and snow tire orders. Due to the impact of production scheduling, there is still a shortage of regular specifications for domestic sales. The overall shipment performance is average, and the finished product inventory reserve is slightly insufficient. In terms of the market, sales in some areas weakened after the impact of summer self-driving travel faded. High temperature weather in some areas in southwest China weakened the willingness to travel. Overall replacement demand remained weak, and business in terminal stores was sluggish.

Futures spot price list

market outlook

Today, the main rubber contract remains high. Recently, weather disturbances in other production areas in China have been obvious. Due to the impact of typhoons, glue output in China's production areas has been significantly reduced. However, the impact of the typhoon exists for a short period of time. After the end, production in the production areas can basically return to normal. Therefore, there are expectations for a decline in cost support. In terms of demand, June to August in previous years were the peak consumption season for terminal demand, and around September it was easy to drive price increases in the spot market. Fundamentally, the current bullish sentiment persists, downstream demand is in a relatively peak season, and rubber spot stocks are declining. In the short term, fundamentals will improve their support for prices, and relatively support rubber to maintain a high and volatile trend.

market analysis

market analysis