[Natural Rubber]: Rubber Weekly Review (September 12)

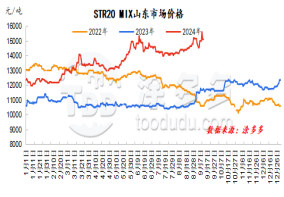

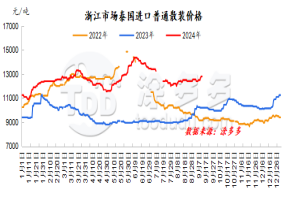

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Rubber prices have improved significantly this week. Recently, weather disturbances in other production areas in China have been obvious. Due to the impact of typhoons, glue output in Chinese production areas has decreased significantly. However, the impact of the typhoon exists for a short period of time, and production in the production areas can basically return to normal after the end., so there is an expectation of a decline in cost support. In terms of demand, June to August in previous years were the peak consumption season for terminal demand, and around September it was easy to drive price increases in the spot market. Fundamentally, the current bullish sentiment persists, downstream demand is in a relatively peak season, and rubber spot stocks are declining. In the short term, fundamentals will improve their support for prices, and relatively support rubber to maintain a high and volatile trend.

natural latex

This week, the offer prices in the Chinese concentrated market rose within a narrow range and remained relatively stable at the end of the week. Traders were enthusiastic about making offers. Rubber tapping and production in China's Hainan production area are still in the recovery stage. In addition, there is no pressure on the supply of spot resources in the sales area. Traders have limited willingness to lower prices, but the wait-and-see attitude of downstream product companies is heating up, and they are not in a good mood for purchasing high-priced raw materials, and the transaction remains in real order negotiations.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, but rainfall disturbances increase, which should continue to pay attention;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The trend of inventory removal in Qingdao, China may ease;

4. Exchange rate, Federal Reserve interest rate hikes, etc.