[Hot Focus]: Malaysia's low concentrated milk stocks are difficult to change

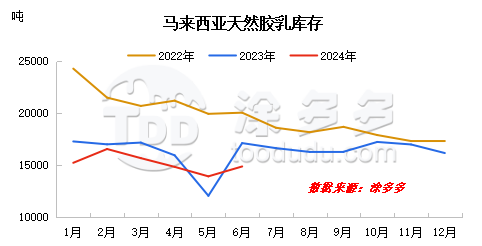

Malaysia's natural latex inventory in July 2024 was 14,900 tons. Judging from the situation from January to July 2024, the overall fluctuations in Malaysia's natural latex inventory were limited, basically maintaining fluctuations around 14,000 tons, and basically at the low level of three years, and Malaysia, as a major consumer of natural latex in the world, has continued to remain low. Why?

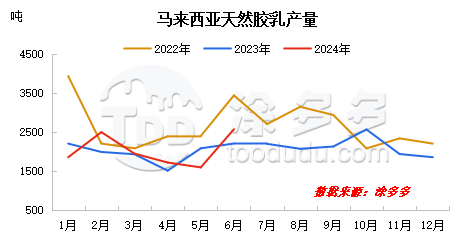

1. Self-produced raw materials are in a transition from low yield to growth, and the amount of raw materials is limited

Malaysia's natural latex output in July 2024 was 2,600 tons, which showed an upward trend on the same month. Judging from the seasonality of natural rubber output, May basically entered the period of increasing Malaysia's output. After entering June and July, Malaysia entered natural rubber. In the state of rapid increase in production, glue production began to increase significantly. However, judging from this year's output, the overall output basically fluctuates back and forth within the range of 0.15-0.25 million tons. This year's output situation has basically not changed much compared with 2023, but it has declined significantly compared with 2022. The overall output situation is stable with limited increase.

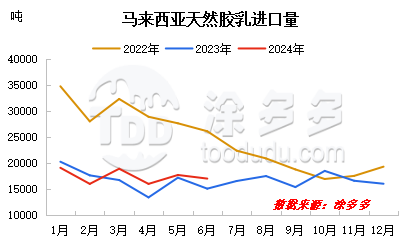

2. Malaysia's natural latex imports remain low

As one of the major consumers of natural latex, Malaysia has few self-produced raw materials and is difficult to meet the normal consumption of downstream processing plants. Therefore, most of the natural latex comes from imports. Malaysia's natural latex imports in July were 17,000 tons, with little overall fluctuations, but there was also a slight decline. On the one hand, the recent heavy rainfall in Thailand has affected the development of rubber tapping work to a certain extent, which relatively supports the firm price of glue in Thailand. In terms of processing plants, the offer from processing plants has been firm, and local traders have low sentiment for high-priced replenishment. On the other hand, the demand for medical protective equipment has cooled in the past one or two years, and the production load of Malaysia's glove factory has dropped to around 50%. The decline in demand from medical glove factories has led to a cooling in the purchase of concentrated milk from the country and Thailand, and Malaysia's natural latex imports continue to hover low.

3. The volume of self-produced raw materials is expected to strengthen, demand is stable, and natural latex inventories moderate their decline

As the world's major supplier of gloves, Malaysia's actual demand has been relatively limited in recent years. The start of glove factories has basically remained at a low level. Some processing plants have indicated that due to demand, the early expansion of production capacity is currently basically stagnant, and demand-side support is weak; On the other hand, Malaysia is currently in a seasonal period of rapid increase in natural rubber production. Self-produced raw materials have increased, and the cost and price of raw material glue have declined. From a cost perspective, the purchasing sentiment of local Malaysian traders has eased.

Judging from the above situation, the increase in self-produced raw materials is expected, the easing of import costs will stimulate traders to replenish stocks, and stable demand and consumption will basically remain relatively stable. Malaysia's natural latex inventories are expected to increase. However, due to suppressed demand, there is limited room for inventory growth.