[Natural Rubber]: Rubber Weekly Review (September 19)

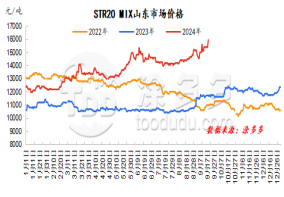

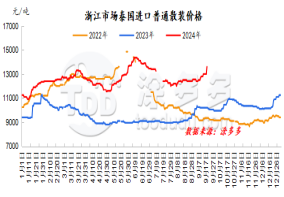

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

This week, the main rubber contract showed a significant upward trend. During the Mid-Autumn Festival holiday, external prices rose mostly, and the overall market atmosphere was warmer. Recently, the weather disturbance in China's foreign producing areas has been obvious. Among them, frequent rainfall in Thailand's producing areas may lead to rubber production reduction. Support on the cost side is strong, and the impact of recent market purchasing and purchasing events has caused the bullish sentiment in the spot market to heat up. On the demand side, before the Mid-Autumn Festival, the semi-steel tire market was trading well, especially some agents, who replenished their stocks appropriately to meet the peak travel demand during the Mid-Autumn Festival. Rubber prices may remain strong for a short period of time.

natural latex

This week, the offer price in China's natural latex spot market remained rising. Traders were more enthusiastic in making offers. The futures market was moving upwards. The raw materials and cost prices at home and abroad continued to rise. With the relatively limited supply of spot resources in the sales area, the holders maintained price increases, but downstream product companies were reluctant to receive high-priced raw materials, and there was a strong wait-and-see atmosphere. It was recommended to pay attention to the guidance of afternoon transactions.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, but rainfall disturbances increase, which should continue to pay attention;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The trend of inventory removal in Qingdao, China may ease;

4. Exchange rate, Federal Reserve interest rate cuts, etc.