[Natural Rubber]: Rubber Weekly Review (September 26)

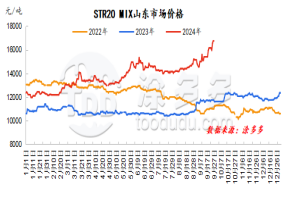

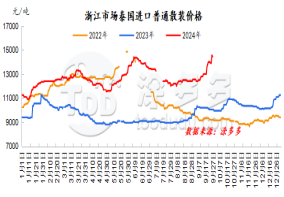

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

This week, the main rubber contract showed a clear upward trend, hitting a new high for the year. This week, the news of a macro reduction in reserve requirements and interest rates was released. As relevant policies continue to be implemented, this round of policies will greatly promote the improvement of economic growth momentum, and the macro environment The warming is obvious. Judging from the current fundamental situation, China's foreign production areas continue to recover, but rainfall and weather in some areas still have an impact. The overall rate of increase is less than expected, and raw material prices are supporting; On the downstream side, China's current downstream construction is stabilizing, and China's automobile industry may gradually move out of the mid-season and off-season; There is basically some support on the supply and demand side. Coupled with the recent macro news, the upward momentum of the main rubber contract will strengthen in the short term.

natural latex

This week, the price of offers on the natural latex spot market in China remained rising. Traders were more enthusiastic about making offers. Futures rose and then fell back. Coupled with the difficulty of completing transactions at high prices in the market, the wait-and-see mood on the market warmed up, and some spot offers loosened slightly. However, due to the lack of improvement in supply side performance, the willingness of holders to lower prices is limited. Downstream product companies have low acceptance of raw materials at the current price, and only purchased just needed them when entering the market, and transactions are maintained under real order negotiations.

Market outlook forecast:

1. The seasonal growth in raw material output in foreign production areas is expected to be obvious, and rainfall should continue to be paid attention to;

2. It is expected that the operating rate of tire sample companies in the next week will fluctuate slightly;

3. The destocking situation of Qingdao, China may ease;

4. Exchange rate, Federal Reserve interest rate cuts, etc.