PVC: Futures highs broke through, strong operations stabilized performance in the high range, and spot prices continued to rise

PVC Futures Analysis:September 27th V2501 contract opening price: 5515, highest price: 5575, lowest price: 5496, position: 826720, settlement price: 5532, yesterday settlement: 5463, up 69, daily trading volume: 1180552 lots, precipitated capital: 3.216 billion, capital outflow: 144 million.

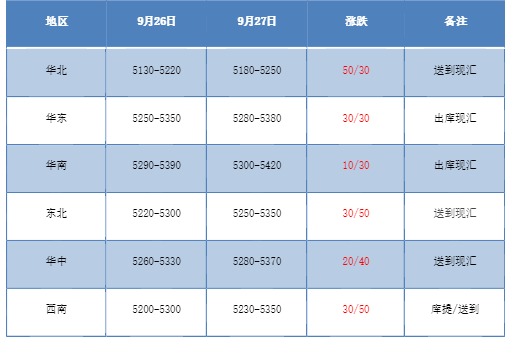

List of comprehensive prices by region: yuan / ton

PVC spot market:China's PVC market mainstream transaction prices continue to rise, the market operation is on the strong side. Valuation comparison: among them, North China rose 30-50 yuan / ton, East China high-end rose 30 yuan / ton, South China rose 10-30 yuan / ton, Northeast region rose 30-50 yuan / ton, Central China increased 20-40 yuan / ton, southwest region rose 30-50 yuan / ton. The ex-factory prices of upstream PVC production enterprises are mostly increased, with an increase of 30-50 yuan per ton, including simultaneous price increases in remote warehouses. Although it coincides with Friday, production enterprises still adjust prices according to market fluctuations. The futures market has a strong operation, the high point has been successfully refreshed, and the spot market price and one-mouth price coexist, but at present, the advantage of spot price is not obvious, including 01 contract in East China-(200), 01 contract in South China-(100). North 01 contract-(400-450), southwest supply heard 01 contract-(550). The basis offer loses a certain reference significance, and the spot market is mainly based on one-bite price. after the spot price rises slightly, there is no obvious change in spot trading, and there is a rigid demand for procurement downstream.

From the perspective of futures:The night price of the PVC2501 contract runs high, and the volatility of the futures price narrows in the night market. The price of the futures rose slightly at the beginning of the morning trading, and the high continued to rise, but then the price fell slightly into the consolidation period, and the price climbed to a high again in the late afternoon. 2501 contracts range from 5496 to 5574 throughout the day, with a spread of 78. 01 contracts reducing 47467 positions to 826720 positions so far, 2505 contracts closing at 5827 and 98515 positions.

PVC Future Forecast:

In terms of futures:The operation of the PVC2501 contract price broke through the high point, and the high point of the market price on Friday was 5574. First of all, the technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) has expanded, and the KD line and MACD line at the daily level show an obvious golden cross trend. Secondly, the operating high point of the futures price rises above the track position for the third time, and runs in a slightly upper range between the middle and upper tracks throughout the day. Since the low point, there has been a good upward trend this week, and at present, the support from the policy is relatively obvious, and the operation of futures prices is stable in the high range, but at present, there are only night trading before National Day and trading sessions next Monday. It is expected that in the short term, the operation of futures prices will continue to be higher than 5480-5600.

Spot aspect:At present, there is a situation of high and continuous rise in the two cities. First of all, the performance of the futures market is strong, that is, the night market is high, and the high point of the futures price has successfully risen into the position on the track again, while the corresponding spot market has also formed a pull up during the period of Friday. whether it is the production enterprise or the middleman shipping price has gone up, the demand side is not sensitive to the price adjustment feedback, there is a certain wait-and-see mood. Policy port to see the evening of September 26, three major measures to promote medium-and long-term funds into the market! The Central Financial Office and the China Securities Regulatory Commission issued important documents: (1) to build a capital market ecology that encourages long-term investment. (2) vigorously develop equity public offering funds and support the steady development of private securities investment funds. (3) efforts should be made to improve the supporting policies and systems for all kinds of medium-and long-term funds to enter the market. Policy port for PVC cash market guidance is relatively obvious, it is expected that the PVC spot market in the short term after the increase on the basis of high consolidation.