Under the game of supply and demand, the caustic soda market is not prosperous in the gold ninth peak season. Can the silver tenth surprise?

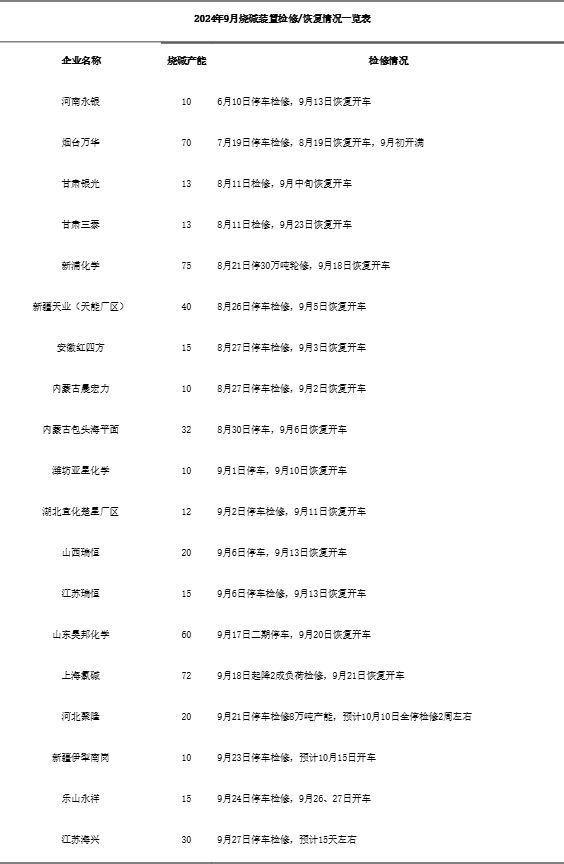

The peak season of Jinjiu is not prosperous, why is the performance of caustic soda market different from that of previous years? First of all, from the perspective of supply, from the situation of previous years, the centralized maintenance of chlor-alkali enterprises in September is relatively obvious, and the amount of maintenance loss will increase to a certain extent compared with the previous month, and the centralized maintenance of chlor-alkali enterprises in autumn will bring certain support to the market, and the price of caustic soda will have a certain upward trend. However, from the point of view of this year, there are not many maintenance devices in chlor-alkali enterprises in September, and the amount of maintenance loss has decreased compared with the same period last year, and there is no obvious support for the price of caustic soda, and the market has not shown an obvious upward trend as in the peak season of previous years. There was only a small increase at the beginning of the month, and then it maintained a lukewarm trend. Judging from the maintenance equipment of chlor-alkali enterprises in September, only Weifang Yaxing Chemical, Hubei Yihua, Shanxi Ruiheng, Jiangsu Ruiheng, Haobang Chemical, Shanghai Chlor-Alkali, Hebei Julong, Xinjiang Yili Nangang, Leshan Yongxiang, Jiangsu Haixing and other devices are reduced or overhauled, and the production capacity is about 2.33 million tons, the maintenance capacity is less, and the maintenance time is short, and there is no obvious support to the market. At the same time, the maintenance equipment in August and before has a recovery plan in September, involving a production capacity of nearly 2 million tons, and a comprehensive comparison of the maintenance and recovery equipment shows that the supply side is not obviously good for the market. The overhaul / restoration of the caustic soda plant in September 2024 is as follows:

Secondly, from the demand side, it also does not give a significant boost to the market. First, the procurement of downstream and traders: when we entered Jinjiu in previous years, the demand of most industries in the lower reaches recovered well, and the purchase of caustic soda by downstream and traders showed an increasing trend, superimposed near the National Day short holiday, and downstream and some traders had a demand for ready goods, supporting the rise in the price of caustic soda. After entering Jinjiu this year, the recovery of downstream demand is not as expected, the start of the main downstream alumina industry is difficult to improve due to the tight supply of raw materials bauxite, viscose staple fiber and printing and dyeing, paper and other industries start lukewarm, downstream performance as a whole there is no bright spot, except for the rigid demand part and do not see more demand, it is difficult to boost the price of caustic soda. Second, the main downstream alumina procurement liquid alkali price situation: in the past two years, the main downstream alumina has continuously raised the liquid alkali procurement price under the atmosphere of Jinjiu, and the market sentiment is relatively high, which also supports the quotation confidence of caustic soda manufacturers. Throughout September this year, the main downstream alumina enterprises in Shandong have not seen any action to adjust the purchasing liquid alkali price, the market atmosphere is flat, and the quotation mentality of operators is cautious.

Can Silver Ten be unexpected?

First, on the supply side: chlor-alkali enterprises still have maintenance devices in October. At present, there are more than 10 sets of maintenance devices planned, involving a production capacity of nearly 3 million tons. At the same time, we do not rule out temporary stop devices, which provide overall or regional support to the market and give a certain boost to prices. In the later stage, with the end of maintenance and the resumption of market supply, prices are expected to decline.

Second, demand: the main downstream alumina enterprises start work or are still affected by the tight supply of bauxite in China, it is difficult to significantly improve, although alumina enterprises have increased the use of imported mines, but the alkali consumption of imported minerals has decreased, so there is no significant increase in caustic soda procurement; downstream non-aluminum industry starts or changes little, the demand is more likely to maintain lukewarm fire, and there is also no obvious increase in caustic soda procurement. Main downstream alumina procurement liquid alkali price: in October, alumina enterprises in Shanxi Province increased the purchase liquid alkali price by 100 yuan / ton, which undoubtedly formed a certain support for the market; alumina procurement prices in Henan and Guangxi are expected to rise.

On the whole, under the device overhaul, the market may be expected to rise in October, but the price increase is relatively limited, while with the recovery of the maintenance device and near the end of the Silver Ten, the contradiction between supply and demand increases, and the market may be expected to move downwards.