Multiple positive factors resonated, driving alumina prices to rise continuously across the board, and futures prices also continued to reach new highs.

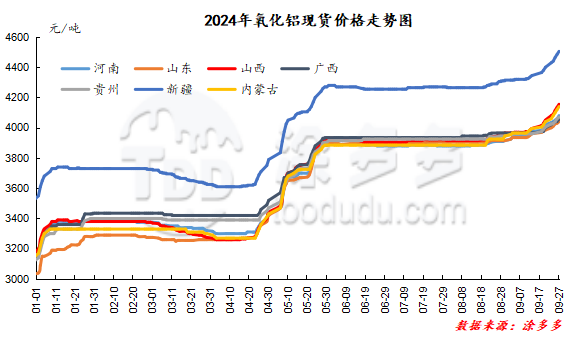

Description of recent Alumina spot Market trend:Since mid-early August 2024, the spot price of alumina has risen for the third time this year, of which prices in Henan, Shanxi, Guangxi and Xinjiang first rose slightly, and rose across the market on August 22. Subsequently, prices in various regions showed a trend of regional increase, which lasted until the beginning of September. The market began to operate steadily on September 5, but after a week of stability, prices showed an upward trend again on September 10, and this time the market was still regionally upward; while after the Mid-Autumn Festival (September 18), prices rose again in an all-round way, and rose at the rate of 5-20 yuan / ton per day.

Comparison of spot prices of alumina: (unit: yuan / ton)

From the beginning of the price rise in mid-early August to the end of September, spot prices in various regions have risen by 110-255 yuan per ton, an increase of 2.79% and 6.56%. The market showed a regional upward trend from mid-early August to early September, although prices rose at this stage, but the overall upward range was not obvious. The rate of increase in each region was only 20-80 yuan per ton, while in just over half a month from September 10 to September 27, prices in all regions rose by 90-180 yuan per ton, with an increase of 2.27% 4.53%.

At this stage, the main factors affecting the rise of alumina spot prices are as follows:

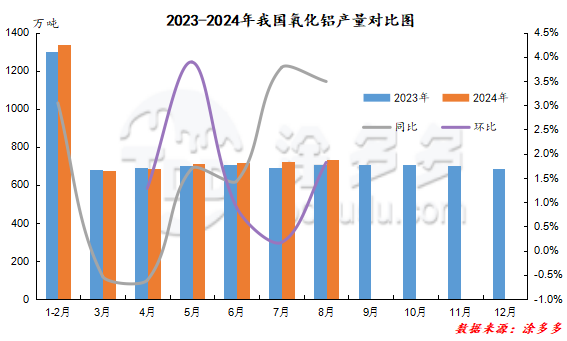

1. Supply: the supply capacity of raw materials and ores is difficult to improve, and the supply of goods in circulation in the alumina spot market continues to be tight. The supply of raw materials and ores has not been significantly improved, and the examination and approval of bauxite mining in China is strict and complicated, coupled with restrictions such as rainfall, environmental protection policies and safety inspection, the supply of mineral insurance in China is still limited; although the use of imported mines has been increased, however, due to the complex types of ores and the limited total amount, the actual output release of alumina is still lower than expected. Alumina production in August was 7.336 million tons, an increase of only 131000 tons from July, an increase of 1.82%. In terms of import volume, due to the continuing tight supply of overseas alumina, the import window was basically closed in August. China's alumina imports have dropped sharply compared with the same period last year. In September, the equipment of alumina enterprises in Henan and Hebei was overhauled, and the supply side was further reduced. Although a few units resumed production, and the new production capacity in some areas was released, it is still difficult to change the situation of tight supply as a whole. Therefore, according to the current situation, the average daily output of alumina in September may decline. The supply side forms a strong support to the market.

2, demand: September entered the traditional peak demand season of downstream electrolytic aluminum, and since July, the operating rate of downstream electrolytic aluminum reached the peak of the year, and will continue to October, downstream procurement demand is strong, boosting the alumina market; coupled with the behavior of replenishing inventory and stock in the lower reaches before the Mid-Autumn Festival and National Day holidays, alumina prices are also clearly supported.

3. Futures: alumina futures began to rebound on September 3, and the main alumina rose more than 2% on September 3. In the middle and first ten days of September, market worries about the US economic recession eased, and the futures market atmosphere warmed up. Alumina also rose strongly, breaking through the 3900 mark on September 12. Subsequently, under the action of various positive factors, such as fundamental support and macro policies, the mood rose, and the market rose step by step, and the futures price rose to 4248 on September 25, the second highest since alumina futures were listed. The continuous rise in the market also gives a certain boost to the spot price.

4. Market mentality: with futures rising strongly and hitting new highs, under the support of tight supply and positive fundamentals, the selling sentiment of most holders increases, the market bullish sentiment is strong, and the price bottom support continues to move up.

On the whole, under the resonance of multiple positive factors, spot prices have risen continuously across the board, and futures prices have also continued to refresh highs.