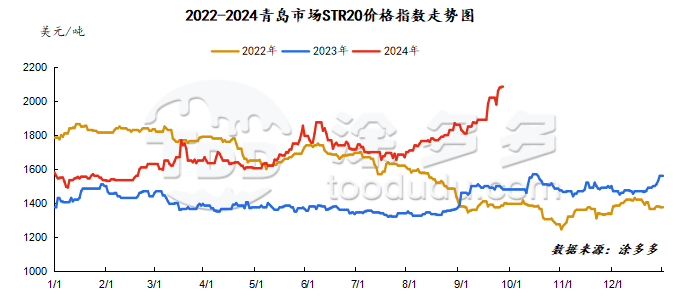

[Natural Rubber]: Rubber Daily Journal (September 29)

Analysis of natural rubber market price on September 29

index

29 SeptemberJune, Natural Rubber Qingdao Market STR20 Price Index2090 beautifulYuan/ton, compared withStable on the previous trading day.

market analysis

Futures market: Closed on holidays

spot market

Supply:

Foreign countries: There is still heavy rainfall in some areas of Thailand, which affects rubber cutting work and factory production and transportation, and the purchase price of raw materials remains high.

VietnamThe weather in the production area is relatively abnormal compared with previous years, precipitation disturbances continue, rubber tapping work is still not smooth, and the overall supply of raw materials falls short of expectations. Some factories are actively purchasing raw materials in order to make up orders。

China: Rubber collection work has been gradually carried out in various areas in the south of Yunnan's production area, and glue has entered the stage of increasing quantity. Affected by market prices, raw glue prices continue to rise.

Rainfall and weather in Hainan's production areas have improved. In order to ensure their own production, some processing plants are actively rushing to buy raw materials, which in turn drives the purchase price of raw materials to continue to rise, and the actual rubber price received by the processing plants remains high.

Demand side:

It is understood that the operating rate of tire companies has dropped slightly, and some all-steel tire companies have now entered the final stage, dragging the overall operating rate down slightly. At the end of the month, coupled with the effect of price increases, the overall shipment performance is still acceptable. In terms of the market, recent price increases announced by tire companies have continued to follow up, and agents have slightly increased their enthusiasm to pick up goods. Some companies have remained on the sidelines. Terminal demand is weak, and retail stores only maintain regular stocking.

Market outlook forecast:

Today is a holiday, futures are closed, and market quotes are scarce. As the National Day holiday approaches, downstream companies have begun maintenance and holiday season before the holiday, dragging down expectations of a decline in overall start-up deposits. The rainfall on the rubber supply side has improved, and the overall output has improved slightly. Coupled with the recent recovery of the macro market and the intensification of market capital games, rubber prices may remain high and volatile. After the National Day holiday, rainfall in Southeast Asia has a trend of easing, expectations for concentrated production in production areas are strong, raw material prices are under pressure, and rubber cost support is weakening. However, the arrival of overseas goods in Hong Kong has a certain shipping schedule, and the liquidity in the spot market is still tight. Inventories continue to be depleted of Lido rubber. There is limited room for downward pressure on rubber prices. After the holiday, Tianjiao continues to operate strongly.