The float glass market is generally stable and promotes volume

The float glass market is generally stable and promotes volume

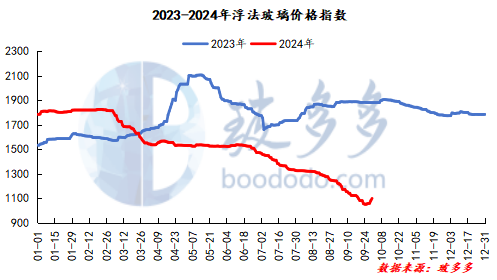

Float glass market price

Analysis of float glass market

Today, the overall price of 5mm float glass in China remains stable, with a slight increase in some areas. Among them, the focus of transactions in the North China market continued to move upwards, with prices increased by 30 yuan/ton to 1150 yuan/ton. The price of 5mm glass in the Beijing-Tianjin-Tangshan and Shahe areas continued to rise. The middle and lower reaches continued to need to stock goods before the festival, and manufacturers 'shipments were in good condition. Quotes in other regions are relatively stable, but as the long holiday approaches, prices of individual companies have increased. Today, a production line in Jiangsu is scheduled to undergo cold repairs, and the start of construction fluctuates within a narrow range; some downstream companies still have the willingness to hoard goods. Some glass manufacturers have made transactions more flexible in order to maintain shipments, and the overall market atmosphere is stable and boosted.

Float Glass Index Analysis

According to data from Boduo, the float glass price index on September 30 was 1,098.91, up 17.73 or 1.64% from the previous working day.

Futures dynamics

Futures dynamics

According to data from Boduo, the opening price of FG2501, the main glass contract, on September 30, was 1205 yuan/ton, and finally closed at 1290 yuan/ton, an increase of 10.07% within the day. The intraday high was 1290 yuan/ton, the lowest was 1194 yuan/ton, holding 857430 lots, month-on-month-on-month-on-month.

Glass futures prices rose sharply today, and the daily limit was closed as of the close. Recently, due to relevant policy support and the shift in macro sentiment, glass futures prices have bottomed out and rebounded, which has also opened up space for future and current arbitrage. The willingness to receive goods in the middle and lower reaches has begun to strengthen. The production and sales of manufacturers in core areas continued to surge sharply over the weekend, and manufacturers 'quotations have been raised one after another, forming a certain positive feedback on futures prices, and the current valuation of glass prices is relatively low, so there is some room for operation in the market. After the holiday, we need to continue to pay attention to the issue of relay increases on the policy side and whether the actual demand of the terminal can be supported by policies and show signs of improvement on a month-on-month basis. Before the above two major issues are falsified, the market may still remain excited and wait for further feedback from the macro-driven and spot market.

market outlook

Recently, driven by active downstream procurement, glass manufacturers have been in a state of de-warehousing as a whole, but the recovery of terminal demand is still slow. It is expected that the spot market will consolidate in a narrow range in the short term, and follow-up needs to pay attention to the adjustment of the fundamentals of the glass market after the holiday.