Electric vehicle transformation to hit hard auto part suppliers, small players: Report

Electricity demand associated with electric vehicles could help power companies generate $11 billion in revenue. Anticipated changes in the deployment of electric vehicles (EVs) in India will have a significant impact on existing automotive component suppliers, according to a report by a consulting firm. Fierce competition from new entrants, including technology companies and battery maker Ernst & Young. From a component supplier perspective, the report, titled “Electrifying India: Building Blocks,” says that while larger players may be able to adapt to large-scale changes, smaller players may be hit the hardest by these disruptions.

The report also points out that there is an urgent need to invest in domestic R&D and manufacturing capabilities to address shortages in the domestic EV supply chain.

He said, “The growth of electric vehicles will bring significant changes to the automotive value chain, including technology, manufacturing systems, ownership models, distribution and after-sales support.”

Explaining why, the company added that while ICE (internal combustion engine) vehicles require around 20,000 moving parts, EVs are relatively simple to manufacture, requiring only 20 moving parts.

This will have a significant impact on existing automakers, disrupting suppliers, he said, adding that the ecosystem will need to build new functionality as the auto repair/service market shrinks significantly.

“These changes are expected to have a significant impact on existing supply,” EY said

From a component supplier perspective, large automotive suppliers may be able to adapt to the rapid changes, but smaller companies may be the most severely disrupted, the report said.

He added: “Existing suppliers will not only have to cope with the changes, but also face stiff competition among new entrants to the industry, such as tech companies and battery makers.”

Ernst & Young reported that OEMs could lose control of parts of the EV value chain because “EVs are much simpler to build than internal combustion engine vehicles,” with fewer moving parts and batteries accounting for about 50 percent of their value.

Additionally, in the EV scenario, component manufacturers’ portfolios will change, with traditional powertrain suppliers losing market share and new EV components such as batteries, motors, controllers, and microprocessors continuing to emerge.

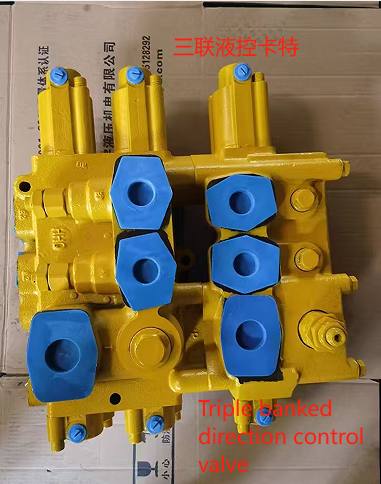

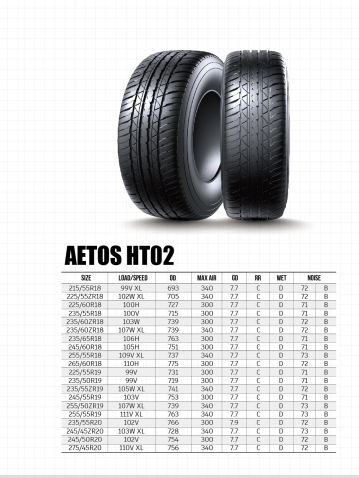

Recommended Suppliers

April 1, 2024

April 1, 2024

March 27, 2024

March 27, 2024  March 27, 2024

March 27, 2024