Why the fall in oil prices may not be so important for Indian economy at the current juncture

Global oil prices have plummeted in recent months on ruble concerns about the health of the Russian economy. The country, a major oil exporter, like many in the Arabian Gulf, has been hit hard by falling oil prices. Oil prices have fallen from more than $110 a barrel in June, when they began, to around $60 a barrel today.

The fall in international oil prices actually represents a “transfer of income” from oil-exporting to oil-importing countries. This fall, consumption and investment in oil-importing countries such as India will be stimulated, offsetting the economic turmoil in oil-exporting countries and restoring the global economy. Economic growth. But good news? ?

“It’s a fairly unique situation where there’s a long-term structural change in the market,” he said Madan Sabnavis, chief economist at CARE Ratings He said. The structural change he was referring to was the massive shale gas boom in the United States. One of the world’s largest oil importers has become a potentially large exporter.

Things have been changing for some time, but OPEC has decided not to cut production even if oil prices fall. This further exacerbated the sharp fall in crude oil prices.

However, here are the reasons why the current fall in oil prices is not so important for the Indian economy.

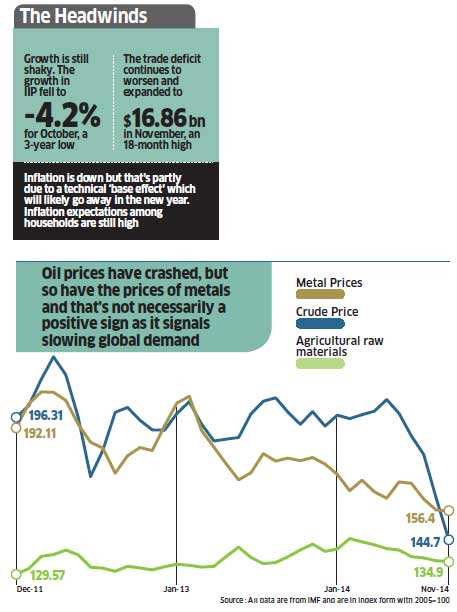

India’s economic growth is still weak at just over 5%. October’s Industrial Production (IIP) growth rate was the largest decline in the last three years. In such a scenario, lower crude oil prices are clearly beneficial as it not only reduces costs for consumers but also for businesses.

However, since the industry is facing uncertain consumer sentiments not only in India but also around the world, lowering costs may only increase profits but contribute very little to them. There is not much incentive for companies to invest in expanding their production capacity.

Global growth is also sluggish. China’s economy is 2 percentage points slower than its peak, and Europe’s economy faces a deflationary outlook, with inflation at about 0.3%. The only major economy growing well is the United States.

One of these is the uncertainty in the global economy (including the Eurozone and China) and the strength of the US economy. factors contributing to the strength of the US dollar. Another global growth indicator-metal prices-a key investment in the industry-was also soft, indicating weakening demand from companies facing a possible market slowdown (see chart).

India’s trade deficit continues to widen. Imports of key raw materials, such as gold, have risen sharply, but the trade deficit has widened to its highest level in the past 18 months, and exports are shrinking as global demand slows. Imports of electronics are also increasing, suggesting that investment may be on the rise, but it remains to be seen whether this import growth will continue.

Inflation expectations remain high. Even if wholesale inflation falls to zero, two major problems remain. First, the recent decline in inflation is partly due to the technical “base effect” of high inflation in the same period last year. However, this base effect will disappear early next year.

Second, the Reserve Bank of India’s inflation expectations survey shows that the household is still pessimistic about prices. Reserve Bank of India Governor Raghuram Rajan warned in his latest policy statement earlier this month after “retail inflation from 99 has fallen sharply since the month”.

He said, “This partly reflects favorable base effects and temporary factors such as prices of fruits and vegetables falling every year, while protein-rich foods such as milk and soya continue to face upward pressure.” According to the survey, inflation expectations have declined, but remain in the low double-digit range due to falling prices of vegetables and other common commodities.” ‘

Rural growth could be hit hard. Rural incomes are likely to fall or at least remain average this year due to weak prices of agricultural commodities and stagnant global commodity markets for cotton, rice and soybean. This does not bode well for the rural economy or the demand for commodities in key sectors from FMCG to automobiles. Agricultural workers still make up nearly half of the country’s labor force.

This could be a reflection of the future health of the economy,” said NR Bhanumurthy, professor at the National Institute of Public Finance and Policy’s “Falling Oil Prices Are Often a Leading Indicator of the Health of the Global Economy” (NIPFP). “. Global economy.” Expectations. “In this uncertain environment, the expectations of investors and businesses are critical to the health of the Indian economy and the global economy.

Recommended Suppliers

April 1, 2024

April 1, 2024  March 27, 2024

March 27, 2024

March 27, 2024

March 27, 2024