PE Market Continued to Be Sideways

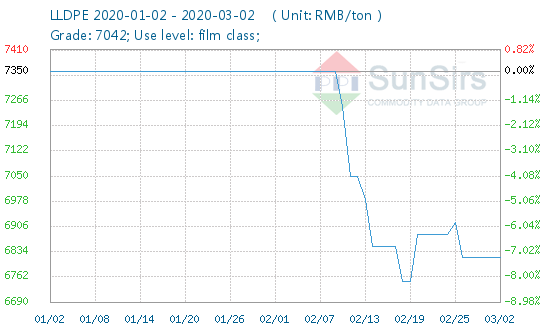

The LLDPE Commodity Index stood at 65.28 on Feb. 28, down 44.47% from the previous day, with a cycle high of 117.56 (Dec. 11, 2013) and up 0.99% from the Feb. 19, 2020 low of 64.64. Refers to the period from September 1, 2011 to the present).

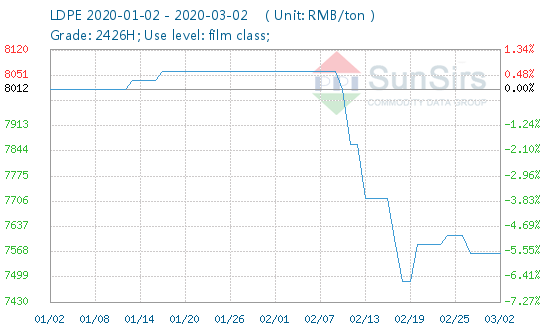

The LDPE Commodity Index for February was 58.85, unchanged from the previous trading day, down 48.07% from 113.33 on December 8, 2013, and up 1.00% from the low of 58.27 on February 19. 2020 (Note: Cycle refers to September 1, 2011 to present).

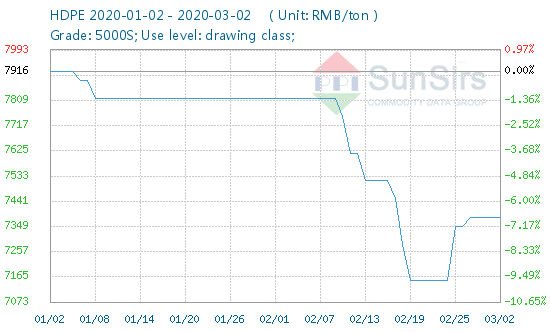

On February 28, the HDPE Product Index stood at 59.84, unchanged from the previous trading day, down 41.52% from the July 24, 2014 high of 102.33 and up 3.26% from the February 24, 2020 low of 57.95. Cyclical Index (as of 9/1/2011).

On February 28, the polyethylene market continued to weaken, showing a sideways trend. the average price of LDPE in East China 2426H was about 7526.5 yuan / ton. HDPE 5000S average price is about 7383.33 yuan / ton. The average price of LLDPE 7042 was about RMB 6,816.67/mt. As of February 28, the price trend of LLDPE, LDPE and HDPE in East China was stable. International oil prices continued to plummet. On the 28th, market prices fell and the overall trading atmosphere continued to be weak. The futures market was on a downward trend, and international oil prices also continued to fall. Petrochemical inventories increased slightly and oilfield supply costs were flat. Franchise shipments were not smooth and profits were poor.

Upstream: On Thursday, international oil prices fell for the fifth consecutive day, hitting a new low in more than a year. U.S. crude prices touched a 13-point month low of $47.84 as a slowing economy and concerns about demand continued to dominate the oil market. On February 27, light crude for April delivery closed at $47.09 per barrel on the New York Mercantile Exchange, down $1.64, or 3.37%. 4 London Brent crude closed at $52.18 a barrel, down $1.25, or 2.77%.

Futures Trend: On February 28, the main contract of polyethylene futures L1905 opened at 8,635, with a high of 8,635, a low of 855, and closed at 8,580, before settling at 8,655 won. It fell 75 points, or 0.87 percent, to 8,590. ` Volume of 222,262 lots, positions 413,566 lots, daily increase in positions-2,846 lots (quoted in yuan / ton)

Market forecast: International oil prices are weak. Cost support is limited and downstream factories are slow to recover. Payment is now more based on demand. Market sentiment is relatively clear. It is expected to remain weak in the short term.

Please feel free to contact toodududu (tdd-global@toodudu.com) if you have any questions.

Blood

2024-04-01

2024-04-01  2024-03-27

2024-03-27  2024-03-27

2024-03-27  2024-03-27

2024-03-27  2024-03-27

2024-03-27