The Peak Season of China Plastic Market Ended, the Market was Negative and the Three Futures Fell significantly

Recent market trends in the plastics industry have been negative. According to todudu monitoring data, after the National Day, a variety of plastic varieties gradually reduced, of which the three major gifts are expected to decline significantly. As of November 15, the monthly decline of each product is PVC-4.03%, PP (pull)-2.44%, LLDPE-2.36%. From a macro perspective, the inflationary market environment for the plastics industry is declining to high levels, despite the Federal Reserve's recent announcement of a slowdown in interest rate hikes leading to a more severe than expected global economic downturn. Levels have remained unchanged for an extended period of time and the risks have impacted petrochemical companies. Most industry players are worried and pessimistic about the future of the market. The peak season has just ended and the impact of international oil prices and remote cost fluctuations have weakened much needed support. There are many negative impacts on plastics, but these negative impacts are environmentally friendly.

Mistrust in the PVC spot market waned after the National Day holiday returned for restocking. Futures took some time to recover throughout October. After November, with the gradual recovery of the basis difference, the spot market has seen a certain degree of decline. In terms of raw materials, the upstream calcium carbide market rose in the range and then fell, down to 3,700 yuan per ton on November 15 after the holiday. Downstream purchasing enthusiasm is not high, and the actual orders are mostly decentralized and small in scale. In addition, when the real estate data published bad news, the terminal must be more cautious. At present, the benchmark price of Rabbit Doodle PVC is RMB 6,028.57/ton. It is expected that in the short term, the PVC market is more wait-and-see, and the integration operation is expected to be relatively stable.

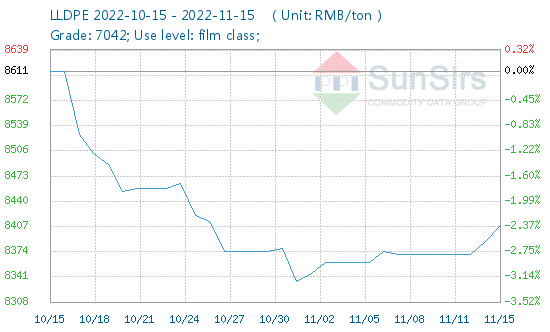

Last month, polyethylene market prices reached a high of 8720.71 10 days ago, the post-holiday demand for raw materials and replenishment impact of yuan / ton. However, the second half of the international crude oil stopped rising and falling, resulting in poor market sentiment. Upstream enterprises have limited ability to accept high prices, and the enthusiasm to enter the market has weakened earlier. The overall start rate of terminal enterprises gradually declined, of which the start rate of agricultural film, packaging film and tubing was on a downward trend. The demand for greenhouse films is coming to an end. Orders for low-pressure tubing and drawing materials were in off-season during the Double 11 period, with limited e-commerce consumer demand. Most downstream enterprises kept replenishment on demand with little incentive. As of November 15, the standard price of LLDPE in commercial cooperatives was RMB 8408.57 per ton, down 2.36%.

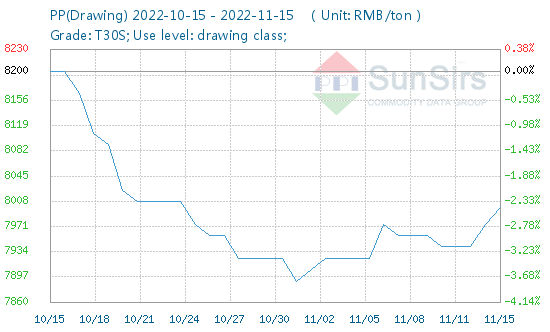

Since October 15, the domestic polypropylene market fell more than rose. In October this year, collective enterprises resumed production and new equipment is expected to be put into operation. Supply pressure increased due to increased inventory. Since then, due to low profits, most refineries have been carrying out their own load-shedding work, and the industry's start-up rate has gradually declined. As of last week, capacity loss has expanded to more than 4 million tons. On the demand side, inventories at major downstream plastics weavers and BOPP companies have declined overall compared to previous years, and raw material inventory levels have also fallen sharply to less than one day. Last November, the PP market environment stopped falling, and the basis differential is now stabilizing, with spot prices stabilizing at around RMB 8,000/ton. Cost recovery of PDH and FMTP is supported. After the supply and demand game, the market returned to the fundamentals.

Recently, the three major spot prices of plastics futures have declined. According to historical data monitored by Thoddu, it is easy to see that the end of the traditional peak season is reflected in the weakening of rigid demand for plastics. However, vertically, this year's post-peak season market seems to be different from previous years.

During the peak selling season, demand in the plastics industry was stronger than expected. However, the plastics market is currently weak, which Todudu called "cautious". Various negative factors reveal the core impact of global inflation on the real business, operators lack of long-term confidence in the market and downstream. Activity in the chain is conservative, and it is difficult to find a breakthrough in the short term. At the macro level, inflation expectations and the international crude oil market are of concern.

If you have any questions, please feel free to contact toodududu (tdd-global@toodudu.com).

2024-04-01

2024-04-01  2024-03-27

2024-03-27  2024-03-27

2024-03-27  2024-03-27

2024-03-27  2024-03-27

2024-03-27