Enjoy the process and experience of the tax exemption policy for international students!!!

First of all, why international students can buy duty-free cars? The official explanation is a preferential policy for returning students to buy cars for their own use in order to support their study abroad and encourage their return to China. Vehicle purchase tax and customs duties on some imported parts are exempted. The basic tax exemption is proportional to the price of the bare car. The more expensive the car, the higher the tax exemption amount. In addition, international students also need to meet the application requirements: 1. For the purpose of study and further education, study and further education at a formal foreign university, college or scientific research institution for more than one year;2. Those who return to China within two years after completing their studies;3. A total of 270 consecutive days or more during studying abroad;4. The first entry after graduation or further study has not exceeded one year;5. Overseas students who study and study in Hong Kong and Macao can also enjoy the same benefits; in recent years, there have been some policy changes affected by the epidemic that need to be understood.

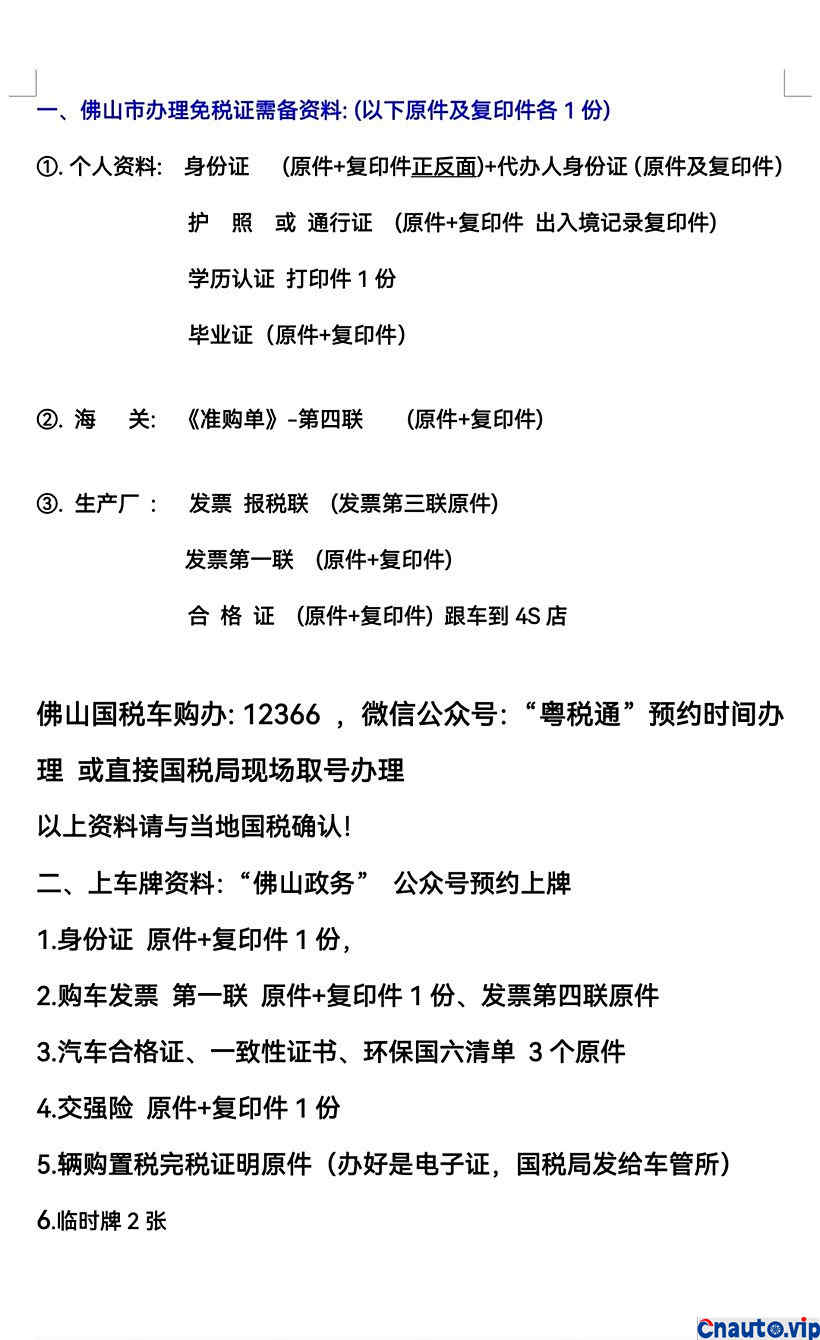

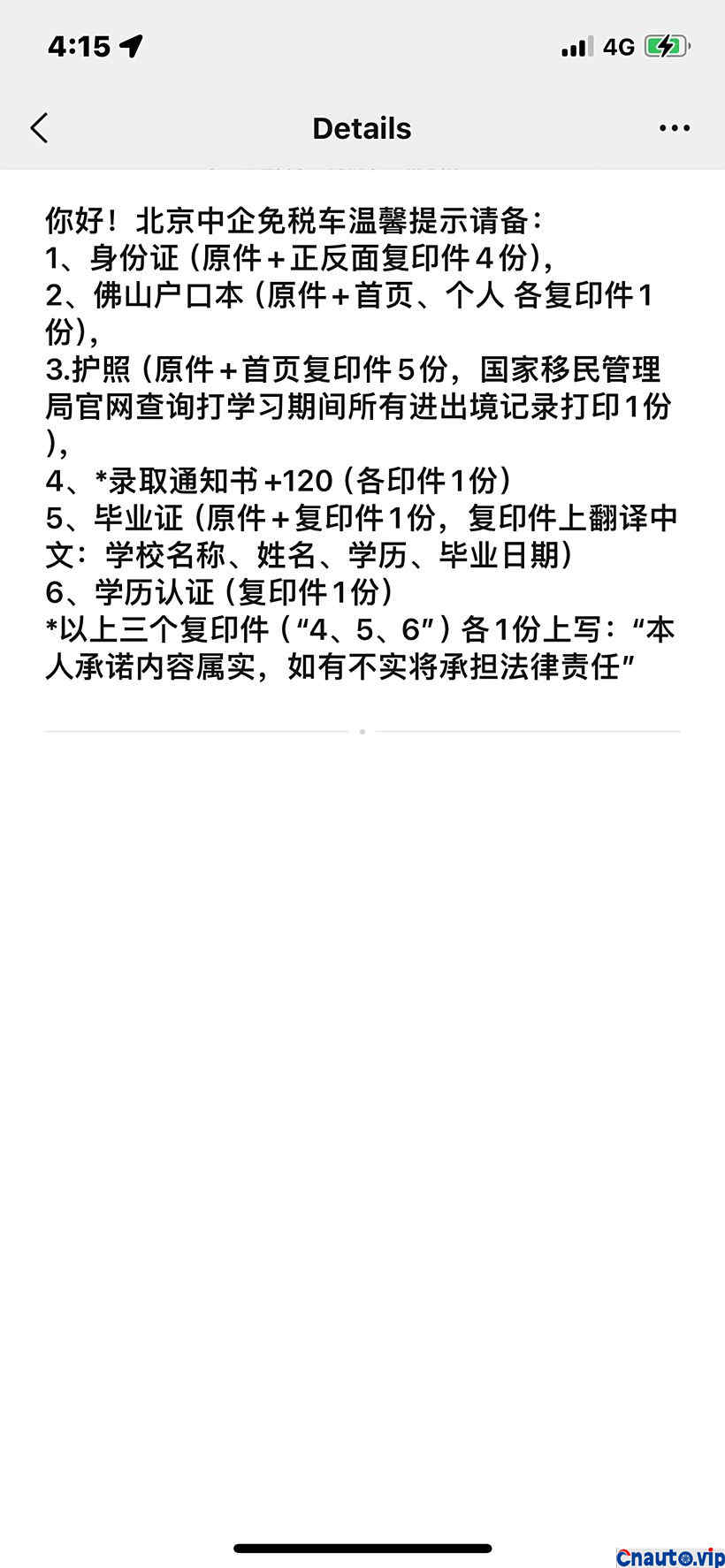

The duty-free cars that international students can buy are joint-venture brands of domestic products, and imported ones do not enjoy the tax exemption policy; basically, all well-known joint-venture brands can be used, which can basically meet the car purchase needs of international students, such as FAW/SAIC Audi, Beijing Benz, BMW Brilliance, FAW/SAIC Volkswagen, Changan Lincoln, etc. Because this is my first time enjoying this policy, I asked an agent to assist me in handling it (you can apply yourself if you are not afraid of trouble). I chose Ms. Luo, the person in charge of China Enterprise Chengyi Foshan. The agency fee is 2500 yuan. From the time I started processing to picking up the car, I only attended the car in person twice. One time was to go to Guangzhou Customs to declare the data, and the other time was to go to the 4s store to pick up the car. The agency basically handles the other procedures for you. The image shows the materials I needed to prepare at that time, but it will change according to changes in policies, and I still need to communicate with the agency for details.

Because international students book duty-free cars directly from the manufacturer, they can go to the 4s store to see which car is suitable for them. I ordered the 23 530li Leading Sports Model. I can customize my car directly in the Mini programs, select and pay a deposit, and then wait for the manufacturer to produce it before shipping the car to the store. Because it was graduation season, many people booked cars, and they waited for two months before the production of the one arrived at the store. The price of the bare car was 399900, and the comfort suit 8400 was selected, so the total price was 408000. At that time, attention was paid to the price reduction in the third quarter to the beginning of 3. The manufacturer also introduced free maintenance for 5 years/100,000 kilometers before the end of the year, so they immediately ordered the car. Before applying for the license, you still need to go to the tax bureau to submit the data, and the tax bureau will issue a tax payment certificate to the vehicle management office and you can apply for the license.

Recommended Suppliers

April 1, 2024

April 1, 2024  March 27, 2024

March 27, 2024

March 27, 2024

March 27, 2024